Trying to find affordable accommodations can totally change your travel budget. Hotel prices bounce around a lot from one booking platform to another.

10 Apps & Tools That Help You Save Money, Time and Sanity: Essential Budget-Friendly Solutions for Daily Productivity

Managing personal finances isn't just about willpower anymore. The right mix of apps and strategies can make the whole process a lot less stressful—sometimes even a little fun.

Modern tech has made it so much easier to budget, automate savings, and dodge the usual headaches. The best money-saving apps of 2025 come packed with automated features, so you don't have to obsessively track every penny or rely on sheer discipline.

These tools really can change how you handle your money. You'll get automated round-ups, expense tracking, subscription management, and goal-based savings—without sinking hours or paying big monthly fees.

Most of these apps don't cost a dime for their core features, and even the premium stuff usually stays under €10 a month. What's cool is how they help you spot spending habits, cut out the waste, and build up savings habits that actually stick for the long haul.

1) YNAB (You Need A Budget)

YNAB (You Need A Budget) really flips the script on budgeting. It uses zero-based budgeting, which means you give every dollar a job before you spend it—no freeloaders allowed.

The app syncs up with your bank accounts and categorizes spending automatically. You can check your budget from your phone, tablet, or laptop, so you're never out of the loop.

What sets YNAB apart is how it teaches you to plan ahead instead of scrambling at the end of the month. It's all about breaking the paycheck-to-paycheck cycle, and honestly, a lot of people find that pretty freeing.

It's not the cheapest option—$14.99 a month or $109 for the year. Still, plenty of users say the savings make up for it.

Newbies get step-by-step tutorials and ongoing support, so you're not left guessing. There are also goal tools for things like emergency funds, vacations, or paying off debt.

If you've ever felt like your money just disappears, YNAB might be the structure you need. Assigning every dollar a purpose really makes you think twice about those impulse buys.

2) PocketGuard

PocketGuard hit the scene in 2015, aiming to help people rein in spending and stash more cash automatically. You link up your bank accounts and cards, and it tracks expenses in real time.

The interface is colorful—pie charts and graphs let you see where your money's going at a glance. No tedious data entry required, which is a relief.

PocketGuard sorts your expenses, bills, debts, and subscriptions into tidy tabs and visuals. It's nice because you can spot problem areas without digging through statements.

The app's "In My Pocket" feature tells you how much you can safely spend after bills and savings. It's a handy way to avoid blowing your budget on a whim.

You'll also get reminders for upcoming bills and subscription renewals. This cuts down on late fees and helps you catch those sneaky subscriptions you forgot about.

The basic version is free, which is always a plus. Premium is $74.99 a year or $12.99 monthly, with extras like debt payoff tools and unlimited accounts.

PocketGuard is especially good for folks who tend to overspend. It just makes it harder to ignore your money habits.

3) Rocket Money

Rocket Money acts like a financial dashboard that helps you get a grip on spending and saving. It's big on subscription management, budgeting, and automating savings.

The app hunts down your recurring subscriptions and lists them out. You can cancel anything you don't want, right from the app—no more forgotten charges draining your account.

Rocket Money builds budgets based on your real spending and income. It auto-categorizes transactions and sends you alerts if you're about to bust your budget in any category.

Its automated savings tool rounds up your purchases and stashes the difference. You can also set custom goals with flexible transfer amounts and schedules.

One unique thing: the app will actually negotiate some of your bills for you, like cable or internet. If you hate haggling, this is a lifesaver.

Apps like Rocket Money mean you don't need a dozen separate tools for every financial task. The basics are free, and premium upgrades unlock bill negotiation and credit monitoring.

4) Digit

Digit quietly saves small amounts for you by analyzing your spending and moving spare change into a separate account. Its algorithms figure out how much you can afford to save without messing up your day-to-day spending.

You link your bank, and Digit keeps tabs on your income and habits. It'll move anywhere from a few cents to a couple bucks at a time into savings.

Digit sends you text updates, so you know how your savings are growing without having to check the app all the time. No more worrying about overdrafts, either.

You can set goals for things like trips or an emergency fund. If things get tight, you can pause transfers with a tap.

Digit even covers overdraft fees if its transfers accidentally push your account too low. That's a nice safety net.

After a free trial, Digit charges a small monthly fee—usually under €10. It's a reasonable price for a set-it-and-forget-it savings app.

If you struggle to save on your own, Digit takes the pressure off. It just handles it for you, based on what you actually spend.

5) Acorns

Acorns is all about turning your spare change into investments. It rounds up every purchase to the next dollar, then invests that little bit into a diversified portfolio.

Just connect your debit and credit cards. Every swipe or tap triggers a round-up, and the app moves the difference into your account automatically.

There are three subscription levels. Acorns Personal is $3 a month for investing and retirement tools.

Personal Plus is $5 and adds a checking account with a debit card. Premium, at $12, includes family accounts for kids.

Acorns invests your round-ups in one of five portfolios, ranging from safe to adventurous. You pick based on your comfort level and goals.

You'll find educational content on investing and personal finance, too. If you want, you can set up recurring investments in addition to round-ups.

It's great for folks who want to invest without thinking about it. Small amounts add up over time, even if you're not actively managing things.

There's no big minimum to get started since you're just using spare change. The monthly fees can eat into returns if your balance stays small, though.

6) Truebill

Truebill, now called Rocket Money, helps you track down subscriptions and cut your monthly expenses. It spots recurring charges and helps you cancel anything you don't want.

The app also includes bill negotiation, budgeting, and credit score tracking. You can see where you're overspending and get a clearer picture of your financial habits.

Truebill negotiates bills by reaching out to service providers on your behalf. You don't have to make the awkward calls yourself.

It scans your accounts for subscriptions and lists them all in one place. That way, you won't miss any sneaky charges.

Smart Savings suggests how much you could save each month, based on your spending. It's a personalized nudge to help you build up your savings.

The app works on both Android and Apple, and the interface is pretty straightforward. Subscription tracking and cancellation come free.

Premium services, like bill negotiation, cost extra—but you only pay a cut of what they actually save you. No savings? No charge.

7) Honey

Honey is a browser extension that hunts for coupon codes and applies them at checkout. It scours thousands of deals in seconds, so you don't have to.

All you do is install it and shop as usual. When you hit the checkout page, Honey jumps in and tests codes automatically.

It works on big sites like Amazon, Target, and Best Buy, plus plenty of smaller stores. If a promo code exists, Honey will try it.

There's also Honey Gold, a cashback program. You earn points at certain stores, then swap them for gift cards later.

Honey's price comparison tool shows you if you can find the same item cheaper elsewhere. It's a quick way to double-check before you buy.

Setup is a breeze—no tech skills needed. The extension stays out of sight until it's time to save you money.

Honey is totally free. They make their money from retailers when you use a coupon, not from you.

It saves both time and cash by skipping the endless hunt for codes. According to Honey, the average user saves $126 a year—not bad for something that runs in the background.

8) Mint

Mint offers free online budget planning and helps people get a grip on their spending patterns. The app categorizes transactions automatically, which makes financial overviews surprisingly clear.

You can track expenses daily, set savings goals, and see your progress toward those targets. Mint syncs with your bank accounts to show real-time spending data, so you don't have to enter everything by hand.

The platform throws in bill reminders and free credit score monitoring. These extras help you avoid late fees and stay on top of your financial health.

But Mint shut down in March 2024, which left millions scrambling for alternatives. Intuit pulled the plug even though budget-conscious folks really liked the service.

Several Mint alternatives now fill this gap, like EveryDollar, Goodbudget, and PocketGuard. These apps offer similar budgeting features and sync with banks too.

Former Mint users can bring their data over to these new platforms. Most replacement apps include expense tracking and budget creation tools, and often you don't need to pay for a subscription.

9) EveryDollar

EveryDollar is a budgeting app made by Dave Ramsey's team, and it sticks to zero-based budgeting. The free budget app asks you to give every dollar a job before you spend it.

You create custom budgets and track expenses manually—no automatic syncing unless you pay up. Users can set financial goals and keep tabs on debt and savings progress as they go.

EveryDollar's free version covers the basics but skips bank account syncing. The premium plan, which costs less than €10 a month, imports transactions for you.

The interface is focused on simplicity, not fancy analytics. Users break down their income and expenses into categories like housing, food, and transportation.

Dave Ramsey's Baby Steps methodology fits right into the app's design. The approach pushes paying off debt in order and building up emergency savings.

This app suits people who want structure in their budgeting. You'll have to put in some work—manually entering transactions and sticking to your own spending limits.

EveryDollar encourages disciplined spending by keeping things straightforward. It's not for everyone, but it's great if you want to get serious about your money.

10) Clarity Money

Clarity Money is a budgeting app that tracks your spending and points out potential savings opportunities. The app connects straight to your bank accounts and gives you a real-time look at your finances.

Clarity Money helps users stay on top of their spending by showing where the cash goes each month. You can quickly check if you're about to overdraft or if you're still on track.

One of its best features is finding forgotten subscriptions that keep charging you. It'll flag those recurring payments, and you might end up saving a surprising amount just by canceling a few.

Clarity Money automatically categorizes transactions, so you don't have to dig through statements. The dashboard is visual and straightforward—no overwhelming charts or data dumps.

The app nudges you to make better financial choices by highlighting overspending. Instead of just showing numbers, it actually suggests what you could do about them.

People like that the interface is simple and doesn't need a finance degree to use. The focus stays on practical money management, not investment advice.

If you're searching for alternatives to Clarity Money, you might try GnuCash or HomeBank. Still, Clarity Money stands out for its subscription tracking and easy-to-use design.

The app is free to download and use, which is always a plus if you're watching your budget.

How Money-Saving Apps and Tools Impact Your Daily Life

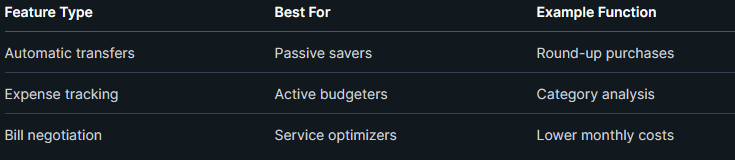

Money-saving apps and tools really change how people handle financial management. They automate the boring stuff, cut down on decision fatigue, and help create actual saving habits.

These digital solutions take out the manual math and give you real-time insights, so it's easier to make better spending decisions as you go about your day.

Streamlining Budgeting and Spending

Budgeting apps mean you don't have to log every expense by hand—they categorize transactions for you. Just connect your bank accounts and credit cards, and you'll get instant notifications about how you're spending.

You'll spend minutes, not hours, on financial record-keeping each week. Apps like Mint and YNAB sync transactions across all your accounts, giving you a big-picture view of your spending.

Real-time spending alerts warn you before you blow your budget. If you're close to maxing out your dining money for the month, your phone will let you know right away.

Most apps create spending reports that point out where your money keeps vanishing. You'll spot forgotten subscriptions or recurring charges that just aren't worth it anymore.

Charts and graphs make your spending easy to understand—way less intimidating than a spreadsheet.

Reducing Stress Through Automation

Automated savings apps take the stress out of remembering to set money aside. You set the rules once, and the app quietly moves money for you after that.

Round-up features send spare change from every purchase straight into savings. Buy a $4.30 coffee? That extra $0.70 lands in your savings account automatically.

Automated bill payments keep you from missing due dates and hurting your credit. You can set up recurring payments for rent, utilities, or loans and forget about it.

Goal-based automation breaks big savings goals into smaller, regular transfers. Instead of scrambling to save $1,200 for a trip, the app moves $100 a month for you.

These systems can make money management feel less overwhelming. People often say they feel more confident about their finances when apps handle the routine stuff.

Making the Most of Small Investments

Investment apps let almost anyone start building wealth, even if you only have $5 or $10 to spare. Traditional brokers used to require bigger balances, which kept a lot of people out.

Micro-investing platforms like Acorns invest your spare change from daily purchases. Over time, those little bits add up thanks to compound growth, and you never really miss the money.

Robo-advisors manage your portfolio for a fraction of the price of a human advisor. You get a diversified investment plan that used to be reserved for the wealthy.

Commission-free trading apps make it possible to buy fractional shares of expensive stocks, so you don't need a ton of cash to get started.

Many investment apps also teach you the basics while you invest. That extra knowledge can make you braver about bigger financial moves down the line.

Tips for Choosing the Right App or Tool

Picking the right money-saving app comes down to matching features with your goals and checking security. It's worth comparing the cost of free and premium versions to see what actually pays off over time.

Evaluating Features and Functionality

Figure out your main savings goal before diving into the app store. Budget trackers are best for monitoring expenses, while round-up apps are for people who want to save without thinking about it.

Look for spending categorization, bill reminders, and goal-setting features. Apps that sync across all your devices just make life easier.

The best money-saving apps of 2025 let you customize alerts and pull up detailed spending reports. Try out the main features during a free trial before you pay for anything.

If an app connects with your existing bank accounts and cards, setup is a breeze. Apps that make you enter everything by hand usually get ignored after a while.

Comparing Free vs. Paid Options

Free versions usually come with basic budgeting tools and a limit on account connections. Premium subscriptions unlock things like investment tracking and more detailed analytics.

Top budgeting apps in 2025 often use a freemium model, so you get core features for free and can pay €3 to €10 monthly for upgrades.

Free features commonly include:

- Basic expense tracking

- Simple budget categories

- Limited account syncing

- Standard notifications

Premium benefits typically offer:

- Unlimited account connections

- Advanced reporting tools

- Priority customer support

- Investment portfolio tracking

Think about whether the app will actually save you more than it costs. If it helps you cut €20 from your monthly bills, a €5 subscription is probably worth it.

Ensuring Privacy and Security

Money-saving apps dig into sensitive financial data, so strong security measures really matter. Before trusting any app, check that it uses bank-level encryption and two-factor authentication.

Legit apps usually team up with well-known financial institutions. They also show off their security certifications—if you can't find those, that's not a great sign.

Sometimes, apps ask for odd permissions, like camera access, even though you just want to budget. That's a red flag and probably not worth the risk.

Key security indicators include:

- 256-bit SSL encryption

- SOC 2 Type II compliance

- Regular security audits

- Transparent privacy policies

When an app only lets you connect your bank in read-only mode, that keeps your money safer. If you see an app demanding your login credentials instead of using secure APIs, steer clear—it's just not worth it.

Take a minute now and then to review which apps have access to your accounts. Revoke permissions for anything you're not actually using.

Money management apps with a solid security history generally let you save money without losing sleep over your data.

We spent some time with this 10-tool combo kit from DEWALT, and honestly, it's pretty wild how much versatility you get in one box. The brushless drill/driver and impact driver take care of most everyday jobs, while the reciprocating and circular saws handle heavier cutting tasks.

We've been testing out a portable power station that might just be the smartest winter investment if you're worried about outages. The RIVER 2 Pro from EcoFlow brings 768Wh of capacity and can run most household essentials when the grid fails, possibly saving you from spoiled groceries, frozen pipes, or even those dreaded hotel bills if the power...

Affordable Christmas Decorations That Will Impress Your Family and Friends: Top Ideas for 2025

Christmas decorations can turn any ordinary space into a festive wonderland. There's something about the right touches that makes gatherings with family and friends feel extra special.

Trying to cut your heating and cooling bills without freezing or sweating all season? We recently checked out the Honeywell Home RTH20B thermostat and honestly, it's a solid pick for folks who want programmable features that actually help lower energy costs.

Managing personal finances isn't just about willpower anymore. The right mix of apps and strategies can make the whole process a lot less stressful—sometimes even a little fun.