Commercial cleaning products are loaded with harsh chemicals. They can irritate your skin, trigger allergies, and honestly, the costs pile up fast.

30-Day No-Spend Challenge: A Complete Guide With Tips & Tracking

Spending habits can spiral out of control if you're not paying attention. Before you know it, you're stressed about money and your savings account looks pretty sad.

The 30-day no-spend challenge gives you a way to hit pause, reset, and actually notice where your money's going. It's a practical way to build up your money management muscles, too.

This challenge means you only buy essentials—think groceries, bills, and getting to work—for 30 straight days. You track every penny and actually see how much you're saving, which is usually kind of eye-opening.

Most people end up shocked by how much they waste on random purchases or subscriptions they forgot about. It's a little humbling, honestly.

Getting ready is key. You've got to set clear rules for what counts as "essential," and you need a way to keep track of your spending. If you stick with it, you'll probably notice you start thinking differently about money even after the month is up.

Key Takeaways

- You need to define what's actually essential and avoid all other purchases for a month.

- Having a tracking method (and some accountability) makes it way more likely you'll finish strong.

- Taking time to reflect at the end helps you spot your real spending habits and build better ones.

What Is the 30-Day No-Spend Challenge?

Basically, you commit to buying only what you truly need for 30 days. You use what you already have and avoid all those little "treat yourself" moments to get a handle on your financial awareness.

Core Principles and Rules

The rules are simple but strict: no spending on anything that isn't essential. That means you can pay for groceries, rent, utilities, and medical stuff—nothing extra.

Essentials usually include:

- Rent or mortgage, plus utilities

- Groceries (not fancy takeout)

- Getting to and from work

- Medical bills and prescriptions

- Debt payments

You'll skip spending on things like:

- Entertainment, takeout, and eating out

- New clothes or accessories

- Home decor

- Books, magazines, streaming, and subscriptions

- Personal care extras (the basics are fine)

Some people tweak the rules a bit for emergencies. Others get really strict and make themselves define what's a true emergency versus just a want in disguise.

You have to be honest with yourself about what you really need. If you aren't, the challenge honestly doesn't work.

Main Goals and Expected Outcomes

The point is to break those automatic spending habits and get more mindful with your cash. Most people save anywhere from $200 to $800, depending on how wild their usual spending is.

Financial perks:

- Immediate savings (sometimes a lot!)

- More money in your emergency fund

- Spotting your spending triggers

- Better budgeting overall

Behavioral changes:

- You start appreciating what you already own

- Impulse buys become less tempting

- It gets easier to say "no" to stuff you don't need

- You think twice before buying anything in the future

People usually find stuff in their house they forgot they owned. It's wild how creative you can get with what's already sitting in your closet or pantry.

It's also a good way to figure out if you're spending because you're bored, stressed, or just want a quick mood boost. The challenge makes those patterns obvious.

Types of No-Spend Challenges

Complete No-Spend means you cut out every non-essential purchase, period. It's pretty intense and not for the faint of heart.

Modified No-Spend lets you set a tiny budget for a specific category—maybe $20 a week for fun, or one treat per weekend. It's more flexible.

Category-Specific focuses on just one problem area, like coffee shops, clothes, or books. This is good if you know exactly where your budget leaks.

Family No-Spend gets everyone in the house involved. It takes some creativity (especially with kids), but it can be surprisingly fun if you plan free activities.

Business No-Spend is for companies looking to slash unnecessary expenses. It's not just a personal thing—businesses do it too.

Pick the version that fits your life. If it's your first time, honestly, don't go for the strictest version right away. Ease in and see how it feels.

Preparing for Your No-Spend Challenge

To set yourself up for success, you need to look at your current spending, figure out what's allowed (and what's not), and separate your must-haves from your nice-to-haves.

Assessing Current Spending Habits

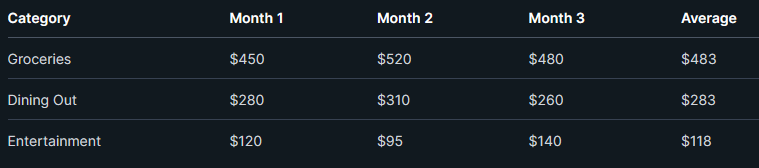

Start by pulling your last three months of bank statements. It's not thrilling, but you'll spot patterns and see where your money just sort of disappears.

Check every account you use:

- Checking

- Credit cards

- Venmo, PayPal, whatever digital wallets you use

- Cash withdrawals

I like a simple spreadsheet for this. Break it down by category—groceries, eating out, entertainment, clothes, subscriptions, and so on.

Add up each category. Which three do you spend the most on? Those are your hot spots.

Don't forget about subscriptions—they're sneaky. Streaming, gyms, random apps, all of it adds up.

Setting Clear Boundaries

Write down exactly what counts as a "purchase" during your challenge. That way, you're not scrambling when you're tempted by a sale or a friend's invite. (You will be tempted.)

Set rules for:

- What's a true emergency (be strict!)

- How you'll handle birthdays or holidays

- Stuff you already planned to buy

- Shared costs with roommates or family

Emergencies should be real emergencies—think doctor visits, fixing your car if you need it for work, or something at home breaking down.

Social stuff is tricky. Maybe allow yourself a set amount for seeing friends, or suggest free hangouts instead.

If you've got subscriptions or bills you already committed to, those keep going. The challenge isn't about skipping rent or utilities.

Write your rules and put them somewhere you'll see every day. Seriously, tape them to your fridge or bathroom mirror. Out of sight, out of mind is real.

Choosing Essential Versus Non-Essential Expenses

Essentials keep you safe and healthy. Non-essentials are mostly about comfort or fun—nice, but not necessary.

Essentials:

- Rent/mortgage

- Utilities

- Groceries

- Getting to work

- Insurance

- Prescriptions

Non-essentials depend on your lifestyle, but usually include coffee runs, streaming, new clothes, and eating out.

Some things are in a gray area. If you run out of shampoo, that's essential. If you want a fancy face mask, that's probably not.

Make two lists—paper or phone, doesn't matter. Go through your monthly spending and decide what's essential and what's not.

Some folks add a "limited essential" list for stuff you only need sometimes, like cleaning supplies or toothpaste when you run out. That can help keep things realistic.

Essential Practical Tips for Success

If you want to make it through the month, you'll need to know your own spending patterns and find better ways to fill your time. It's not just about willpower—having backup plans and some self-awareness helps a ton.

Identifying Spending Triggers

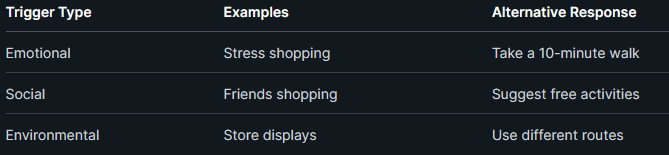

Emotional triggers are sneaky. Try rating your mood before you want to buy something (1-10 scale works). Most people spend when they're stressed, bored, sad, or celebrating.

Environmental triggers are just as bad. Walking past your favorite store, scrolling Instagram ads, or getting sale emails can set you off.

Time of day matters too. Lots of folks overspend on lunch breaks, lazy Sundays, or late at night while half-watching TV.

Try tracking your patterns for a few days before you start. You'll probably spot some habits you didn't realize you had.

Replacing Shopping With Free Activities

Physical stuff helps—go for a walk, do some stretches, or dance around your kitchen. It gets your mind off shopping and costs nothing.

Creative hobbies fill the gap, too. Sketch, write, rearrange your furniture, whatever feels fun and uses what you already have.

Social time doesn't have to mean spending money. Call a friend, write a real letter, or just hang out at home with family. It's more rewarding anyway.

Learning something new is a great distraction. Grab a library book, watch a free YouTube tutorial, or try a new skill with stuff you already own.

Home projects are satisfying and productive. Organize a closet, deep clean, or plan your meals for the week. You'll feel accomplished—and probably save money in the process.

Staying Motivated Throughout the Month

Daily check-ins really help keep your goals front and center. Jotting down your "why" every morning and tallying up how much you've saved so far can give you a little boost.

Visual reminders make it harder to forget what you're working toward. Sticky notes on your wallet, a phone background with your savings goal, or a countdown calendar—these little things keep the challenge in your face, for better or worse.

Progress tracking lets you see what you've actually achieved. Mark down daily savings, snap photos of your organized spaces, or keep a running list of free things you've done—it all adds up.

Accountability systems bring in a bit of outside pressure. Share your progress with family, post occasional updates on social, or just text a friend your daily win—sometimes you need someone else to notice.

Reward milestones keep things from getting too grim. After a week, maybe take an extra-long bath or watch a movie you love. Two weeks in, start planning what you'll actually buy with your savings—just not yet.

Effective Tracking Methods

If you want your no-spend challenge to stick, you've got to keep an eye on things. Whether you're a spreadsheet person or glued to your phone, tracking helps you spot spending patterns and stay honest for those 30 days.

Using Expense Trackers and Apps

Apps like Mint, YNAB, and PocketGuard do a lot of the heavy lifting—they'll categorize your spending and ping you with alerts. Just link up your accounts and watch your purchases show up in real time (for better or worse).

Key features to look for:

- Automatic transaction importing

- Customizable spending categories

- Budget alerts and notifications

- Visual spending reports

Some apps have neat features just for challenges. Goodbudget uses the envelope system, which really fits a no-spend mindset. Spendee's bright charts make tracking a little more fun—if you're into that.

Wallet and Money Lover are free and pretty straightforward, though you'll have to enter things yourself. That can be a pain, but it gives you more control. Upgrading to premium usually costs a few bucks a month if you want fancier reports.

Creating a Simple Tracking Spreadsheet

Spreadsheets don't have to be fancy—just three columns: Date, Item, and Amount. Write down every purchase attempt, even if you talked yourself out of it. It's weirdly satisfying and shows you where temptation hits.

Essential spreadsheet elements:

- Daily spending totals

- Category breakdowns (food, entertainment, clothing)

- Notes column for why you almost spent

- Running balance calculations

Google Sheets is great if you want to share your progress with someone else. Excel has templates and formulas if you're into that sort of thing. I like color-coding to make it obvious what's a need and what's just a want.

Try adding weekend vs. weekday patterns—spending habits shift a lot. A "temptation score" from 1-10 can help you spot your weak spots, too.

Daily and Weekly Check-Ins

Daily reviews shouldn't take more than a few minutes. Just look at what almost made you spend and how you handled it—was it boredom, stress, or just a good sale?

Daily check-in questions:

- What did I almost buy?

- Did I pick a free alternative?

- How hard was it to say no?

Weekly reviews go a bit deeper. Tally up how much you've saved and figure out which days or situations tripped you up the most.

Sunday nights work well for planning the week ahead. You can prep for known temptations, like work lunches or social stuff. If something isn't working, this is the time to tweak your strategy.

Managing Challenges and Staying Accountable

Let's be real—temptation is everywhere, and motivation can tank fast. You need a few tricks for accountability and some ways to celebrate that don't involve spending cash.

Overcoming Common Obstacles

Social pressure might be the biggest pain point. Friends will invite you out for dinner or shopping, probably without knowing you're on a no-spend kick.

Communication strategies can help:

- Tell your friends and family what you're doing

- Suggest free alternatives like movie nights at home or a walk in the park

- Offer to host instead of going out

Emotional spending is a sneaky one. Stress, boredom, or just wanting to celebrate can throw you off track before you know it.

Try figuring out your triggers:

- Keep a quick journal about how you feel before you want to spend

- Swap in something else—call a friend, go for a walk, whatever works

- Use the 24-hour rule before you buy anything that isn't essential

Sometimes life throws a curveball—medical bills, car trouble, work stuff. These can mess with your plans fast.

Set up some emergency guidelines:

- Decide what's a real emergency before you start

- Keep a tiny emergency fund if you can

- Log emergency spending separately so you don't lose track

Enlisting Support From Friends and Family

Having an accountability buddy makes a huge difference. Family or close friends can nudge you along and remind you why you started.

Good accountability systems usually have regular check-ins:

- Text each other weekly about wins and struggles

- Share your tracking sheet or app

- Quick calls when you're tempted to splurge

If you live with someone, make sure they're on board. You don't want surprise takeout orders or arguments over groceries.

Family coordination tips:

- Agree on what's essential before you get started

- Pick one person to handle any emergency spending

- Plan free entertainment together so no one feels left out

Online groups can help too:

- Join a no-spend challenge group on social media

- Share your ups and downs—people get it

- Read other folks' stories for a little extra motivation

Rewarding Your Progress Without Spending

Don't skip celebrating your wins. You need to feel like you're getting something out of all this effort.

Free rewards can actually feel pretty good:

- Take a long bath or wander outside for a while

- Hit up the library, go hiking—anything that costs nothing

- Sleep in or finally watch that movie you've been saving

Time-based rewards work too:

- Call a friend you haven't talked to in ages

- Cook something fancy with what's already in your kitchen

- Spend time on a hobby you've neglected

Looking forward to spending later can be motivating:

- Research what you'll buy after the challenge

- Make a wish list and compare prices

- See how much closer you are to a big goal, like a trip

Honestly, just updating your savings total or crossing off another day feels pretty great. Sometimes that's reward enough.

Post-Challenge Reflection and Next Steps

Finishing a 30-day no-spend challenge gives you a snapshot of your spending habits and willpower. The real magic comes when you look back, figure out what worked, and maybe set up a system for next time.

Analyzing Financial Impact

Take a minute to compare your spending before and after the challenge. How much did you actually save? That number is your proof.

Track these metrics:

- Total saved during the challenge

- How much you cut discretionary spending by (percentages help)

- Impulse buys you dodged

- Which categories gave you the biggest savings

Plug your usual monthly expenses into a simple spreadsheet, then add your challenge month numbers next to them. The difference jumps out at you.

A lot of people find they save 20–40% just by skipping non-essentials. Maybe you dropped a subscription or stopped eating out. Seeing those numbers makes the effort feel worth it.

Building Long-Term Money Habits

Short-term changes are one thing, but making them stick is another. Look at what actually helped during the month and see if you can keep it up.

Some long-term strategies to try:

- Wait 24 hours before buying anything that isn't a true need

- Set monthly caps for fun money or treats

- Use cash envelopes for stuff like entertainment

- Do a weekly check-in to keep yourself honest

Meal planning and cooking at home often get easier after a no-spend month. Keeping that going can save you a surprising amount—and it's usually healthier, too.

Social stuff tends to shift toward free or cheap options during the challenge. Suggesting budget-friendly hangouts helps you stay connected without blowing your progress.

Planning Future No-Spend Challenges

Regular no-spend challenges can really shake up your spending habits and help you hit those financial goals. It's smart to plan the next one around your own financial calendar and whatever life's currently throwing at you.

Optimal timing considerations:

- Right after big spending months, like holidays or vacations

- Before making a major purchase—great for building up a little savings cushion

- Quarterly, just to keep your finances in check

- During quieter months when you're less likely to get swept up in social plans

You don't always have to cut out every non-essential. Some folks just target one category—maybe clothes, or takeout, or all those little entertainment splurges.

People often ramp up the difficulty as they go. Maybe you start with a week, then stretch it to 30 days, and eventually try a 60-day run with tougher rules.

Tracking gets easier (and maybe a bit nerdier) over time. Some people use apps, others stick to spreadsheets, and a few just jot everything down in a notebook—whatever keeps you honest through the year.

The start of a new year always feels like a fresh shot at getting your money right. It's a chance to look at how you've been spending and try some changes that could actually stick.

The holidays bring joy and connection, but let's be honest—they can bring financial headaches too. Plenty of families overspend at Christmas, and nobody wants debt hanging around in January.

Most people think frugality means deprivation, but honestly, it's not that black and white. Building a frugal life you actually enjoy starts with changing how you think about money, not just how much you cut back.

Managing money as a couple? That's a whole different ballgame than budgeting solo. You've got two people with their own spending quirks, income levels, and dreams for the future, all trying to pull in the same direction without losing their independence.

Spending habits can spiral out of control if you're not paying attention. Before you know it, you're stressed about money and your savings account looks pretty sad.