Commercial cleaning products are loaded with harsh chemicals. They can irritate your skin, trigger allergies, and honestly, the costs pile up fast.

50/30/20 Budgeting Method Explained: A Simple Guide for Smart Money Management

Managing your money doesn't have to mean wrestling with endless spreadsheets or tracking every last dollar. The 50/30/20 budgeting method lays out a refreshingly simple way to split your after-tax income into just three basic categories—making it doable for nearly anyone, no matter how much you love (or hate) math.

The 50/30/20 rule says you put 50% of your after-tax income toward essentials like rent and groceries, 30% toward "wants" (think movies or eating out), and 20% into savings and paying off debt. U.S. Senator Elizabeth Warren popularized this approach, and it gives you a structure without forcing you to sweat every penny or constantly monitor your spending habits.

Honestly, the simplicity is a big part of the appeal—especially if you find traditional budgeting a bit much. By focusing on just three buckets instead of a tangle of categories, you can build good financial habits and still cover your basics, enjoy life, and stash something away for later.

Key Takeaways

- The 50/30/20 rule splits your after-tax income into needs, wants, and savings—each with its own percentage.

- This budgeting method keeps math to a minimum and flexes to fit your situation or cost of living.

- It helps you cover must-have expenses but also leaves space for fun and future goals.

What Is the 50/30/20 Budgeting Method?

The 50/30/20 budgeting method slices up your after-tax income into three parts: 50% for needs, 30% for wants, and 20% for savings. Elizabeth Warren brought this idea into the spotlight, and it's become a go-to tool for balancing essentials, fun, and savings—without making your brain hurt.

Origins and Popularity

Elizabeth Warren introduced the 50/30/20 budget rule in her book "All Your Worth: The Ultimate Lifetime Money Plan." She later became a U.S. Senator, but this budgeting approach probably helped more people than most political speeches.

People latched onto the rule because it's way easier than the complicated systems out there. Unlike zero-based budgeting, which makes you account for every dollar, this one just gives you a simple structure that almost anyone can wrap their head around.

Financial advisors and budgeting apps often point beginners to this method. It strikes a balance between meeting your needs, saving for the future, and leaving room for a little fun—without a ton of hassle.

How the Method Works

The 50/30/20 rule tells you to divvy up your after-tax income into three buckets. Each one has its own role in keeping your finances steady.

50% - Needs Essential expenses you can't skip include:

- Rent or mortgage payments

- Utilities and insurance

- Groceries and transportation

- Minimum debt payments

- Healthcare costs

30% - Wants Discretionary spending covers the fun stuff like:

- Entertainment and dining out

- Travel and vacations

- Subscriptions and upgrades

- Extra clothes or accessories you don't really need

20% - Savings This chunk goes toward your financial goals:

- Emergency fund contributions

- Retirement savings

- Investment accounts

- Extra debt payments (above the minimum)

Why Use the 50/30/20 Rule?

The 50/30/20 method sticks out because it's just so easy to use. You don't need fancy math or a complicated tracking system—just three numbers to remember.

This method lets you put must-haves first and makes sure you're saving, but it also gives you a "fun money" category so you don't feel deprived. That's probably why more people actually stick with it.

The rule puts half your budget toward essentials, which helps you avoid blowing too much on extras. With 20% automatically going to savings, you build a safety net without thinking about it every month.

You can tweak the percentages if you need to, depending on your situation. That flexibility is huge—life isn't one-size-fits-all, right?

Breaking Down the 50/30/20 Rule

The 50/30/20 budget rule sorts your after-tax income into three spending buckets, each with its own level of priority. Half your money goes to essentials, while the rest gets split between enjoyment and building your financial future.

The 50%: Needs and Essential Expenses

Essential expenses eat up the biggest slice of the pie because, well, you can't really skip them. Needs include rent or mortgage, groceries, utilities, insurance, and minimum debt payments.

Housing usually takes the biggest bite here—rent, mortgage, taxes, and basic upkeep all count. Transportation covers car payments, gas, public transit, and car insurance.

Health insurance premiums and must-have medical expenses belong in this group, too.

Core needs include:

- Rent or mortgage and utilities

- Groceries and basic food

- Health insurance and medical care

- Getting to work (transportation)

- Minimum debt payments

If your needs eat up more than 50% of your income, it might be time to think about downsizing or finding cheaper options. Spending more than half on the basics? That's a red flag to rethink your lifestyle.

The 30%: Wants and Discretionary Spending

Discretionary spending is all about the things that make life nicer but aren't strictly necessary. This bucket covers entertainment, eating out, hobbies, and splurging on upgrades.

Wants can mean picking steak over hamburger or going for a name brand when a generic would do. Even gym memberships count here if you could just work out at home.

Think of entertainment as streaming services, concerts, movies, and fun activities. Traveling for fun—not work—fits in this group, too.

Common discretionary expenses:

- Restaurant meals and takeout

- Entertainment subscriptions

- Clothing that's more for style than need

- Trips and vacations

- Hobby gear and supplies

The 30% slice gives you space to enjoy yourself but keeps things in check. If your income changes or your goals shift, this is usually the easiest category to adjust.

The 20%: Savings and Debt Repayment

Savings is where you build your safety net and work toward bigger goals. This includes emergency funds, retirement, and paying down debt faster than required. Start with an emergency fund before chasing long-term dreams.

Ideally, your emergency fund should cover three to six months of expenses. If you've got high-interest debt, tackle that first—it's usually smarter than focusing on low-yield savings.

Retirement savings through your 401(k) or IRA helps you grow wealth over time. Investments in index funds or similar options can boost your long-term financial health.

Savings priorities usually go like this:

- Emergency fund (3-6 months' expenses)

- Pay off high-interest debt

- Contribute to retirement accounts

- Invest in other accounts

- Save for big goals (like a house down payment)

Depositing money in high-yield savings and building an emergency fund set the stage for everything else. Setting up automatic transfers makes it way easier to stick with your goals.

How to Calculate and Allocate Your Budget

To make the 50/30/20 method work, you first need to figure out your actual take-home pay. Once you've got that number, split it up according to the three categories—no advanced math, just some basic division and a little honesty about your spending. That's how you build a budget that actually works for you.

Calculating Your After-Tax Income

Your after-tax income forms the basis for all 50/30/20 calculations. This is the actual money that lands in your bank account after taxes, insurance premiums, and other deductions disappear from your gross salary.

Net income is a whole different animal from gross income. Gross income is what you earn before deductions; net income is what you can actually spend.

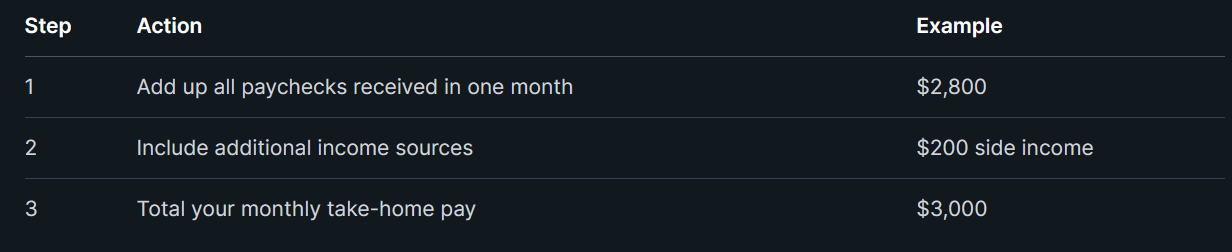

To figure out your monthly after-tax income, just follow these steps:

Think about your cost of living when deciding if this budgeting method works for you. Living somewhere expensive? You might need to tweak the percentages to cover your essentials.

Track your income for a couple months—two or three is usually enough—to get a real average. If your income jumps around, calculate based on the lowest amount you expect to keep things steady.

Assigning Income to Each Category

Once you know your after-tax income, you can split it up using the 50/30/20 framework to build a spending plan that actually fits your life. This budgeting strategy divides your take-home pay into three buckets, each with its own job.

To figure out how much goes where, multiply your net income by each percentage:

Needs (50%)

- Rent or mortgage payments

- Utilities and insurance

- Groceries and transportation

- Minimum debt payments

Wants (30%)

- Entertainment and dining out

- Hobbies and subscriptions

- Non-essential shopping

- Vacation savings

Savings (20%)

- Emergency fund contributions

- Retirement account deposits

- Investment contributions

- Extra debt payments

If you bring home $4,000 after taxes each month, you'd have $2,000 for needs, $1,200 for wants, and $800 for savings. Set up automatic transfers so you don't have to fuss with this every month.

Practical Steps to Start Using the 50/30/20 Method

Getting started with the 50/30/20 method means tracking what you already spend and setting up systems that run on autopilot. The trick is to sort your expenses into clear categories and make automation your friend.

Sorting Expenses Into Categories

Your first move: figure out your after-tax income and put every expense you have into needs, wants, or savings. Pull up your bank statements and receipts—yeah, all of them—and list out monthly expenses.

Needs (50% of income):

- Housing payments or rent

- Groceries and essential food

- Utilities and phone bills

- Transportation costs

- Insurance premiums

- Minimum debt payments

Wants (30% of income):

- Dining out and entertainment

- Hobbies and subscriptions

- Non-essential shopping

- Gym memberships

Honestly, lots of folks have trouble telling needs from wants. Cable TV feels vital, but it's a want. Swapping to generic groceries can shave down your needs spending, too.

Budgeting apps or spreadsheets help you keep each category straight. The envelope system works—assign every dollar before you spend it, and don't cheat.

Automating Your Savings

Automatic transfers make saving that 20% nearly painless. Almost every bank lets you set up free, repeating transfers between accounts.

Open separate accounts for different savings goals. One for emergencies, one for vacations, whatever works for you. That way, you won't accidentally dip into your emergency fund for concert tickets.

Automatic savings strategies:

- Set up transfers on payday

- Use employer retirement plan deductions

- Schedule weekly or bi-weekly transfers

- Round up purchases to savings

Your employer can split your paycheck for you—just ask them to send 20% straight to savings. This way, you don't get tempted to spend it first.

Consider high-yield savings accounts for your emergency fund. For long-term stuff like retirement, investment accounts make more sense.

Tracking Progress and Adjusting

Keep an eye on things so your budget doesn't drift off course. Check in every month to see where you're actually spending versus what you planned.

Budgeting apps make this way easier by syncing with your bank and sorting transactions. Some even ping you if you blow past your category limits.

Monthly review checklist:

- Compare actual vs. planned spending

- Spot overspending

- Tweak percentages if necessary

- Update your goals

Life happens—budgets need to flex. Get a raise? Bump up savings. Lose a job? You might need to pause or lower savings for a bit. The 50/30/20 idea is built for this kind of flexibility.

If your income jumps around—like for freelancers or seasonal workers—average a few months to find your baseline. On good months, sock away extra savings to cushion the lean times.

Track your net worth every month if you can stomach it. Even tiny improvements add up over time, and that's what actually builds real financial stability.

Tips and Considerations for Personalizing Your Budget

The classic 50/30/20 setup isn't one-size-fits-all. If you have unpredictable income or something unusual going on in your finances, you might need to tweak things. Freelancers and gig workers often need different strategies, and some households do better with custom percentage splits tailored to their situation.

Accounting for Variable Income and Freelancers

If you freelance or work on commission, applying fixed percentages is a pain. Your pay goes up and down, so figuring out exact dollar amounts for each category isn't always realistic.

Two approaches seem to work for variable income:

- Apply the 50/30/20 percentages to whatever you earn each month

- Build your budget around a conservative, baseline income

The first option keeps spending proportional. One month you make $3,000, the next it's $5,000—you just split it up by percentage each time.

The conservative baseline option gives you more stability. Base your budget on your lowest regular month, and treat any extra as bonus savings. That way, you don't overspend when you have a windfall.

Freelancers should watch their income patterns for a few months to get a sense of what's realistic. Building a bigger emergency fund is a must since unpredictable income brings more financial risk.

Adapting Percentages for Unique Circumstances

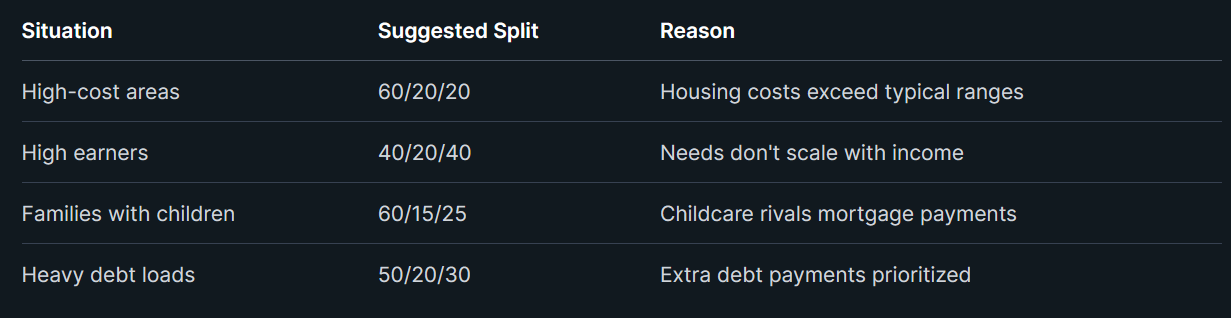

Sometimes, your life just doesn't fit the standard 50/30/20 mold. Where you live, your family size, or your debt load might call for a different split.

Some common modifications:

High-cost living areas often need 55% to 60% for needs because of rent and transportation. Usually, this means shrinking the wants category, not cutting savings entirely.

If you earn a lot, your needs don't double just because your paycheck does. That opens the door to saving 40% or more if you're motivated.

Families with little kids might need 60% for needs during the expensive childcare years. The trick is to shift that money into savings once those costs drop.

Benefits and Limitations of the 50/30/20 Budget

The 50/30/20 budgeting method has some real upsides for building financial security since it's so straightforward. But let's be honest: high rent or unpredictable income can make sticking to it a challenge.

Advantages for Financial Health

The 50/30/20 rule nudges you toward smarter spending and saving—and that's a good thing. Its simple, percentage-based structure means you don't have to do a bunch of complicated math. Beginners especially appreciate that.

Some key benefits:

- Easy to track without fancy spreadsheets

- Built-in savings for emergencies

- Flexible—you can adjust the percentages as life changes

- Helps you draw a line between essentials and nice-to-haves

The method naturally supports long-term financial goals by sending 20% straight to savings and debt payoff. You don't need to be a finance nerd—just stick to the percentages and your emergency fund and retirement account will grow.

As you get more aware of your spending, your financial security starts to improve. The structured framework helps you avoid blowing too much on wants, while still making sure you cover your real needs.

Potential Drawbacks and Common Challenges

The 50/30/20 rule may not work for individuals with high debt payments or folks living in pricey cities where housing eats up more than half their income.

Plenty of Americans know these percentages just don't add up for their situation.

Common limitations:

- Housing costs often exceed 50% of income in major cities

- High-interest debt requires more aggressive repayment strategies

- Irregular income makes consistent percentage allocation difficult

- Doesn't account for specific investment goals or major purchases

Finance experts note the rule is unrealistic for most people due to rising living costs.

Essential expenses frequently blow past the 50% mark, leaving little for wants or savings.

The system just doesn't adjust for different financial responsibilities at various life stages.

Young professionals with student loans or parents juggling childcare bills might find these tidy percentages don't fit real life.

Integrating Savings, Investments, and Debt Payoff

The 20% savings chunk in the 50/30/20 rule has to stretch across a lot of goals.

Emergency funds take top priority, then retirement, and—if there's anything left—extra debt payments beyond the minimums.

Building an Emergency Fund

An emergency fund sits at the heart of the 20% savings slice.

Most financial experts say you should have at least three months of emergency savings to cover stuff like job loss or a medical curveball.

Building that cushion means putting aside money every month, even if it's not much.

If someone nets $4,000 a month, they'd try to set aside $800 for savings—but the emergency fund comes first.

Emergency Fund Priority Order:

- First $1,000: Quick starter emergency fund

- Next phase: 3-6 months of essential expenses

- Ongoing: Replenish immediately after any withdrawals

High-yield savings accounts usually offer the best mix of easy access and a bit of growth for your emergency stash.

These accounts pay more interest than old-school savings, and you can grab your cash fast if you need it.

Once you hit your emergency fund goal, you can finally point those monthly savings toward investments or knocking out debt faster.

Investing and Retirement Accounts

After the emergency fund's in place, retirement savings should get the spotlight.

That 20% savings piece works best when you use it for tax-advantaged accounts with solid long-term growth.

401(k) contributions really deserve a look, especially if your employer matches what you put in.

It's basically free money for your retirement, and it adds up quicker than you'd think.

IRA accounts give you more ways to save for retirement.

Traditional IRAs help with taxes now, while Roth IRAs let you take money out tax-free later on.

Investment Account Types:

- 401(k): Employer-sponsored with potential matching

- Traditional IRA: Tax-deductible contributions

- Roth IRA: Tax-free retirement withdrawals

- Taxable accounts: For goals beyond retirement

When it comes to investing, most people do well with a mix of index funds or target-date funds.

They give you a wide spread across the market and usually keep fees low and things simple.

If you're young, you can lean more into stocks for growth, but as retirement gets closer, it's smart to dial things back and play it safer.

Strategies for Paying Off Debt

Debt payoff strategies sit right alongside savings and investments in that 20% allocation chunk. Knocking out high-interest debt usually gives you returns that honestly beat most investment gains out there.

Debt avalanche method means you tackle the highest interest rate debts first, while you keep making minimum payments on everything else. Credit cards and personal loans usually jump to the front of the line, leaving student loans or mortgages for later.

Debt snowball approach flips things and goes after your smallest balances first. This little psychological trick can really help some folks stay motivated as they see debts disappear one by one.

Monthly Debt Strategy:

- Pay minimums on all debts (these fall into the 50% needs category)

- Use extra payments from your 20% savings to hammer away at your target debt

- Once debt's gone, funnel those payments into investments

It's worth pausing to say: balancing debt payoff and retirement savings gets tricky, especially if your employer offers 401(k) matching. That match is basically free money—hard to pass up, even if you're staring down some debt.

When you finally ditch high-interest debt, those freed-up payments can really supercharge your retirement fund or help refill your emergency savings. It's a bit of a relief, honestly.

The start of a new year always feels like a fresh shot at getting your money right. It's a chance to look at how you've been spending and try some changes that could actually stick.

The holidays bring joy and connection, but let's be honest—they can bring financial headaches too. Plenty of families overspend at Christmas, and nobody wants debt hanging around in January.