Commercial cleaning products are loaded with harsh chemicals. They can irritate your skin, trigger allergies, and honestly, the costs pile up fast.

Frugal Finance for Two: How Couples Can Budget, Split Costs & Stay on the Same Page

Managing money as a couple? That's a whole different ballgame than budgeting solo. You've got two people with their own spending quirks, income levels, and dreams for the future, all trying to pull in the same direction without losing their independence.

Couples who budget together can reduce financial stress and stay aligned on priorities when they use the right strategies.

The key to successful couple budgeting really comes down to open communication, splitting expenses fairly (think income ratios), and just picking a budgeting system you both can live with.

Some couples merge everything, others keep things separate but share certain costs. Either way, transparency and mutual respect for each other's money style make up the foundation.

Frugal couples who stay financially and emotionally aligned treat their budget as a team project, not a solo mission. When both people pitch in, you avoid the usual traps—like resentment or those classic "where did the money go?" arguments.

Key Takeaways

- Clear communication about goals and regular check-ins keep couple budgeting on track.

- Split expenses equally or by income, depending on what feels fair for both of you.

- Automated savings and emergency funds can take the edge off financial stress and help you build for the future.

Why Couples Need to Budget Together

Joint budgeting builds a sense of financial harmony. It's about building trust through shared transparency, finding common ground on money values, and having a plan for those inevitable "do we really need that?" debates.

Building Financial Trust and Transparency

Open communication about finances cuts down on arguments and keeps both people accountable. If you both know where the money's going, sneaky spending gets a lot harder.

When you share bank access and talk openly about purchases, you build trust. Partners who review statements together usually feel more secure than those who keep everything separate and mysterious.

Key transparency practices include:

- Monthly budget review meetings

- Shared access to all accounts

- Discussing purchases over agreed dollar amounts

- Using joint tracking apps or spreadsheets

When both partners have a say in financial choices, trust grows. The higher earner shouldn't just make big purchases without checking in with their partner.

Financial transparency sometimes reveals things you'd otherwise miss. Maybe you spot a subscription you forgot to cancel, or your partner finds a way to trim costs in a category you overlooked.

Aligning Money Values and Goals

Married couples need to budget together if they want to move toward big goals—buying a house, retiring early, or crushing debt. If you're not on the same page, you might end up working against each other.

Different upbringings shape different money values. Maybe one of you loves travel and adventure, while the other just wants a fat safety net for emergencies. Budgeting together brings those differences out into the open.

Common areas requiring alignment:

- Emergency fund size (3-6 months of expenses)

- Retirement contribution percentages

- Major purchase timelines

- Debt payoff strategies

Getting aligned usually means compromise. Maybe the travel lover agrees to fewer trips for now, so you can build up savings, while the cautious partner relaxes a bit on experiences.

Specific, measurable goals work better than vague ideas. "Save $7,000 for a Southeast Asia trip by November 2026" beats "let's save for vacation" every time.

Navigating Financial Differences

Let's be real: you probably won't agree on everything. Budgeting together helps couples manage money better by giving you a framework to handle those differences.

If your incomes are way off, you'll need to tread carefully. Proportional budgeting lets the higher earner put in more, but both people still feel like their contribution matters.

Common difference management strategies:

- Separate "fun money" for each person

- Taking turns deciding on bigger purchases

- Setting spending thresholds that require both to agree

- Regular budget tweaks and check-ins

Some couples mix joint and separate accounts. Shared expenses come from one pot, while personal spending uses individual "allowances."

Patience goes a long way here. The spender learns to think about the future, and the saver learns to loosen up and enjoy the present, at least a little.

Choosing the Right Budgeting Method for Couples

How you split and combine finances depends on your incomes, where you're at in your relationship, and just plain personal preference. There's no one-size-fits-all, but three main options tend to come up.

Joint Versus Separate Finances

Fully joint finances means you pool everything—income, bills, savings—and make all decisions together. Married couples with similar money habits often go this route.

With joint accounts, you both see every transaction. Budgeting as a couple gets simpler because there's only one set of accounts to track.

Completely separate finances means each person keeps their own money and just splits shared bills. You get privacy and autonomy, and don't have to justify every coffee run.

This setup can cool off arguments about different spending styles. You do you, they do them—just make sure the bills get paid.

Hybrid approaches (aka "yours, mine, and ours") give you a joint account for shared stuff and personal accounts for your own spending. Honestly, a lot of couples land here.

The 50/50 Split Approach

The 50/50 split is dead simple: you both pay half of everything—rent, groceries, the works—no matter who makes more.

It feels fair for couples with similar incomes and lifestyles. You each shoulder the same load, and there's less math involved.

Advantages of 50/50 splits:

- Easy to calculate and track

- Both take equal responsibility

- Crystal-clear expense division

- No need to haggle over income differences

Most couples using this method keep separate accounts and just transfer money for shared costs. Some use apps to track who owes what so nothing gets forgotten.

But if one person makes a lot less, 50/50 can get tough. The lower earner might struggle to keep up or feel pressured to downgrade their lifestyle.

Income-Based and Proportional Contributions

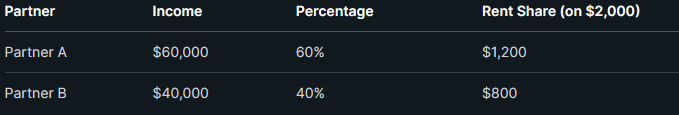

Proportional contributions tie what you pay to what you earn. If one partner brings in 60% of the income, they cover 60% of the bills.

This method helps keep things fair when incomes aren't even. The higher earner pays more, so the lower earner isn't stretched too thin.

How to calculate proportional contributions:

- Add up both incomes

- Divide each income by the total

- Apply those percentages to shared bills

Say Partner A makes $60k, Partner B makes $40k. Total: $100k. So A pays 60%, B pays 40% of shared stuff.

Tracking gets a bit trickier here, especially if your incomes change. Some people feel weird if they're paying way more, or worry about dependence, so it's worth talking through those feelings.

How to Split Expenses Fairly

You've got options for splitting costs—pick what feels fair and sustainable for both of you. The main thing? Both partners need to agree it's working.

Dividing Shared Bills and Living Costs

The 50/50 split is the easiest if your incomes are close. You both toss in the same amount for rent, utilities, groceries, and so on.

Equal Split Method:

- Split bills right down the middle

- Open a joint account for shared costs

- Both deposit the same amount every month

Some folks prefer to divvy up bills instead. Maybe one pays rent, the other covers utilities and streaming. This works if you want to keep your own accounts but still share the load.

Bill Assignment Strategy:

- Assign bills as "yours" and "mine"

- Try to keep monthly totals about equal

- Switch things up if expenses change

Managing Irregular and Individual Expenses

Stuff like car repairs or medical bills doesn't pop up every month, so you need a plan. Set up some ground rules for these wildcards in advance.

A lot of couples set dollar limits for solo spending—say, anything over $100 or $200 needs a quick check-in first.

Individual Expense Guidelines:

- Set a dollar amount (like $100-$200) where you'll talk before spending

- Keep separate "fun money" accounts for personal stuff

- Discuss big, irregular expenses together before pulling the trigger

Personal things—clothes, hobbies, your own subscriptions—usually come from your individual accounts. That way, you keep some freedom without messing up shared goals.

Adjusting for Income Discrepancies

Couples with big income gaps usually find proportional splitting way fairer than just splitting things 50/50. If one person brings in $60,000 and the other makes $40,000, they might go with a 60/40 split for bills.

Proportional Calculation Example:

Another approach: each partner tosses the same percentage of their income into the shared pot. Both might chip in 35% of what they earn monthly, so the sacrifice feels equal even if the dollar amounts aren't.

This way, both people end up with about the same amount of spending money after covering joint expenses. It's not foolproof, but it keeps things feeling balanced.

Using Budgeting Apps Like HoneyDue

Budgeting apps like HoneyDue make it easier for couples to track shared expenses and stay transparent about money. These apps pull all your financial info into one place you both can see.

HoneyDue Features:

- Expense tracking across multiple accounts

- Bill reminders so nothing slips through the cracks

- Spending notifications for both partners

- Budget categories for different types of expenses

With HoneyDue, you can check account balances, see what bills are coming up, and spot spending patterns—without having to hand over your actual bank login details. You can even set alerts for big purchases or low balances.

Honestly, a lot of couples feel less stressed using these apps because there's way less guessing about who paid what or how much is left in the account. The shared view helps avoid those annoying "Wait, did you pay that bill?" arguments.

Regular check-ins on the app can take the place of those awkward money talks and keep both people in the loop about where things stand.

Creating a Couple's Budget Step-by-Step

If you want a budget that actually works, you've got to track every dollar coming in, see where it all goes, and try to get on the same page about what matters most. It's not rocket science, but it does take a bit of effort and honesty.

Listing All Sources of Income

Start by figuring out your total after-tax income as a couple. Don't forget paychecks, side hustles, rental income, dividends, and any government payments—everything counts.

Primary Income Sources:

- Partner 1's take-home pay

- Partner 2's take-home pay

- Side gig money

- Investment dividends

- Rental income

If your income jumps around month to month, you can either average out the last year or use your lowest month as a baseline. The second option's a bit more conservative, but it means you're less likely to overspend.

Update your numbers whenever there's a raise, job change, or new income stream. Managing money as a team gets so much easier when you both know exactly what's coming in.

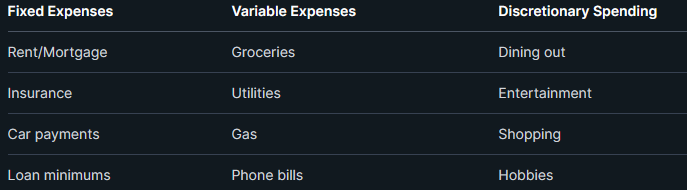

Identifying and Categorizing Joint Expenses

Make a list of every expense you share or pay for individually. This is where most surprises pop up, but it's crucial if you want to find ways to cut back.

Essential Categories:

Go through at least three months of bank and credit card statements. You'll spot patterns you'd probably miss otherwise. Don't forget about those yearly things—car registration, holidays, vacations—just divide the total by 12 and add it in.

It's wild how often couples realize they're blowing way more than they thought in certain areas. Budgeting together makes it a lot easier to spot those trouble spots and figure out where to trim.

Setting and Allocating Money for Shared Goals

Decide what you both want to save for, and put a real dollar amount on each thing. If you don't, it's way too easy for goals to just stay dreams.

Goal Prioritization Framework:

- Emergency fund (3-6 months of expenses)

- High-interest debt payoff

- Retirement savings (10-15% of income)

- Home down payment

- Vacation or big splurges

You'll want to talk about what matters most to each of you. Maybe one of you is all about travel and the other's dreaming of a house. You'll probably have to compromise a bit, but that's just part of the deal.

You can actually build a budget in under 10 minutes if you just assign numbers to each goal. Try to make your income minus expenses and savings come out to zero—give every dollar a job, basically.

Essential Financial Safety Nets for Couples

Couples who make it work long-term usually have a few financial safety nets in place. Emergency funds, some kind of plan for debt, and savings for specific goals give you a fighting chance when life throws a curveball.

Building an Emergency Fund Together

You'll want to stash away 3-6 months of living expenses in a shared emergency fund. That means enough to cover rent, utilities, groceries, and debt minimums for both of you.

The quickest way: both partners set up automatic transfers to a high-yield savings account. If your incomes aren't close, just contribute based on what you each make.

Set a monthly savings target—maybe $200-500—and keep at it until you hit your goal. Doing it monthly feels more doable than trying to save a huge lump sum all at once.

Decide ahead of time what counts as an emergency. Medical stuff, job loss, busted appliances? Sure. Vacations or new tech toys? Not so much.

Check your emergency fund every few months. Big life changes—marriage, babies, buying a house—mean you should probably bump up your target.

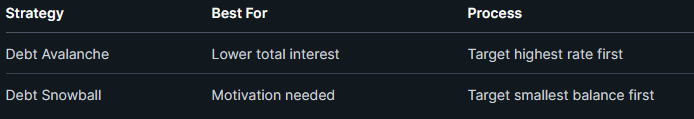

Planning for Debt Payments and Reducing Liabilities

Treat debt like a joint project, even if the account's only in one person's name. Tackling it together keeps things fair and lessens resentment.

The debt avalanche method makes the most sense if you want to save on interest. Pay minimums everywhere, then throw extra cash at the highest-rate debt first.

If you need more motivation, the debt snowball works too. Knock out your smallest debts first for quick wins, even if it costs a bit more in interest.

Pick one strategy and stick with it. Mixing methods just gets confusing and slows down your progress.

Saving for Future Goals

Set up separate savings accounts for each of your goals. Want a house, a vacation, or a new car? Give each one its own account and deadline.

Short-term goals (less than 2 years out) should go in a high-yield savings account. Not exciting, but safe.

If you're saving for something 2-5 years out, you can take a little more risk. Maybe a conservative investment or a bond fund—just don't get too wild.

Split up who manages which goal if it makes sense. One of you might love tracking vacation savings, while the other's more into home upgrades.

Automate transfers so you're not arguing every month about whether to save or spend. Money that moves itself gets saved way more reliably.

Check in on your goals every few months. Life changes, so you might need to adjust how much you're saving or even what you're saving for.

Staying Aligned and Communicating About Money

Talking about money regularly is the only way to avoid drama and keep working toward what you both want. Set up check-ins, tweak the budget together, and leave each other some room for personal spending—nobody likes feeling micromanaged.

Scheduling Regular Money Check-Ins

Couples who actually put money talks on the calendar tend to stay on the same page. Once a month or every couple of weeks usually works—often enough to keep tabs, but not so much that you're constantly talking about money.

Each meeting should hit three things: look at how you spent compared to your budget, talk about any big expenses coming up, and air out any worries. Take turns leading so it's not always one person running the show.

Essential Check-In Topics:

- Monthly spending review by category

- Progress toward savings goals

- Upcoming large expenses or changes

- Any financial stress or concerns

Both partners need access to the same info. Shared apps or spreadsheets make it easier to prep for these talks and keep things fair.

Don't try to talk money when you're stressed or distracted. Block out time and treat it like a team problem—not a chance to point fingers. That's when you actually get somewhere.

Adjusting Budgets and Goals as a Team

Budgets always need tweaking as life shifts. Successful couples reevaluate their financial plans regularly, especially after big changes like new jobs or moving somewhere else.

Whenever the budget changes, both partners should talk through the reasons. They need to agree on new allocations so nobody feels left out of important decisions.

Common Triggers for Budget Adjustments:

- Income changes (raises, job loss, new employment)

- Moving to a new home or city

- Health issues or medical expenses

- New family members or dependents

- Changed financial goals or timelines

Adjusting goals also means making decisions as a team. Maybe one person wants to save for a trip while the other prefers to knock out debt—those trade-offs need real conversation and a bit of give and take.

It helps to jot down these changes and the reasons behind them. Couples can look back later and see if their tweaks actually worked out or if they need another round of adjustments.

Maintaining Autonomy and Personal Spending

Individual spending freedom helps keep resentment at bay, but it also keeps the budget on track. A lot of couples just set aside "fun money" for each partner, usually with cash envelopes or separate prepaid cards.

This personal spending money doesn't need any discussion or approval from the other partner. You get to spend your allocation on whatever you want—no guilt, no explanations.

Personal Spending Guidelines:

- Both partners get the same amount

- Stick to cash or prepaid cards to keep things honest

- No interrogations about what the money goes toward

- No borrowing from next month's stash

- Take a look at the numbers every few months to see if they still make sense

Figuring out the right amount is tricky—it needs to fit the budget but still feel like actual freedom. Honestly, starting small and bumping it up later feels less risky than going big from the start.

Some couples also set a spending threshold for joint decisions. If something costs more than $100 or $200, they'll talk it over; smaller purchases stay in the personal zone, no matter what budget category they're in.

The start of a new year always feels like a fresh shot at getting your money right. It's a chance to look at how you've been spending and try some changes that could actually stick.

The holidays bring joy and connection, but let's be honest—they can bring financial headaches too. Plenty of families overspend at Christmas, and nobody wants debt hanging around in January.

Most people think frugality means deprivation, but honestly, it's not that black and white. Building a frugal life you actually enjoy starts with changing how you think about money, not just how much you cut back.

Managing money as a couple? That's a whole different ballgame than budgeting solo. You've got two people with their own spending quirks, income levels, and dreams for the future, all trying to pull in the same direction without losing their independence.

Spending habits can spiral out of control if you're not paying attention. Before you know it, you're stressed about money and your savings account looks pretty sad.