Commercial cleaning products are loaded with harsh chemicals. They can irritate your skin, trigger allergies, and honestly, the costs pile up fast.

Introduction to Effective Budgeting: Strategies for Financial Success

Effective budgeting can turn financial chaos into something much more manageable. It lets you make smarter decisions about your money while you work toward goals that actually matter.

Lots of people struggle with managing their finances simply because they never set up a system for tracking what comes in and what goes out. A well-designed budget acts as a kind of financial roadmap, helping you allocate your income with purpose, cut unnecessary spending, and slowly build up wealth over time.

Getting the basics of budgeting goes way beyond jotting down numbers on a page. You really need to develop thoughtful strategies for managing income and expenses while building habits that stick and support your long-term financial health.

The process means figuring out your priorities, setting goals that you can actually reach, and putting systems in place so you don't feel overwhelmed every time you check your bank account.

Learning a few proven budgeting techniques and tools can make the journey from uncertainty to stability a lot more realistic. Whether you earn a little or a lot, the core principles of effective budgeting don't really change—they just adapt to your situation.

What Is Effective Budgeting?

Effective budgeting means making a plan that matches your income to your expenses, all while supporting your financial goals. The process covers different approaches and timeframes, helping people keep their money under control instead of letting it slip away.

Defining a Budget

A budget is basically a plan that lays out what you expect to earn and what you plan to spend over a set period of time. Good budgeting strategies let you divvy up your earnings to cover the essentials while still working toward bigger financial objectives.

Tracking actual spending against what you planned to spend can really open your eyes. It shows you patterns and makes it obvious where you need to tweak things.

Most people go with monthly budgets, but some like to work weekly or even yearly. The timeframe should fit how often you get paid and what your spending habits look like.

Key Budget Components:

- Income: Wages, salaries, and other earnings

- Fixed Expenses: Rent, insurance, loan payments

- Variable Expenses: Groceries, utilities, entertainment

- Savings Goals: Emergency funds, retirement contributions

Purpose and Benefits

Budgeting fundamentals are all about taking charge of your money and not letting spending get out of hand. Building a budget holds you accountable and gives you a sense of direction for your financial choices.

Budgets take the guesswork out of money management. They set boundaries for what you can spend in each area and help make sure you don't miss any bills.

The process also uncovers expenses you don't need that drain your bank account. You might find subscriptions you forgot or realize some habits cost way more than you thought.

Primary Benefits:

- Prevents running out of money before payday

- Reduces financial stress and anxiety

- Enables progress toward long-term goals

- Improves debt repayment strategies

- Builds emergency fund reserves

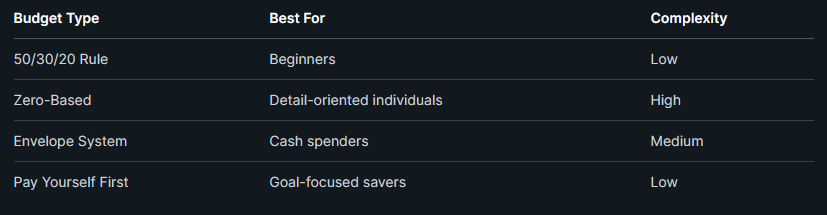

Common Types of Budgets

Popular budgeting methods like the 50/30/20 rule make things simpler. That rule splits your money into 50% for needs, 30% for wants, and 20% for savings.

Zero-based budgets force you to give every dollar a job, so your income minus expenses always equals zero. It's thorough, but it takes some effort to track everything.

The envelope system hands you cash for each spending category. When an envelope is empty, that's it—you wait until the next budget period before spending more in that area.

Each method tends to fit certain personalities or financial situations better than others. Honestly, the best one is the one you'll actually stick with.

Key Elements of a Successful Budget

A solid budget boils down to three things: knowing your income, understanding what bills and expenses you just can't avoid, and figuring out how much you have left for wants versus needs. These basics are the backbone for tracking your money the right way.

Understanding Income Sources

Calculating income is where every budget starts. You've got to know exactly how much is coming in each month if you want any hope of setting reasonable limits.

Main income sources are usually salary, wages, tips, and commissions. If you're self-employed, it's smart to average out your last few months—three to six is a good window—so you don't overestimate.

Secondary income might come from:

- Rental property income

- Investment dividends and interest

- Social Security or disability payments

- Alimony or child support

- Side business profits

- Freelance work earnings

It's best to use after-tax income for your budget. Subtract taxes, insurance, and retirement contributions first, so you're only dealing with what you can actually spend.

If your income swings a lot, be conservative. Base your budget on your lowest-earning months, not the highest, just to be safe.

Identifying Fixed and Variable Expenses

Fixed expenses are the bills you just can't skip and that rarely change. These are your non-negotiables every month.

Common fixed expenses:

- Rent or mortgage payments

- Insurance premiums (auto, health, home)

- Loan payments (student, personal, auto)

- Subscription services

- Cell phone bills

Variable expenses shift from month to month, but you still need them. You can control these a bit more by adjusting your habits.

Typical variable expenses:

- Groceries and household supplies

- Utilities (electricity, gas, water)

- Gasoline and transportation costs

- Medical expenses and prescriptions

- Home and car maintenance

Knowing the difference helps you prioritize what's necessary and spot areas to cut back. Fixed expenses get paid first, then you tackle the essentials among your variable expenses.

Discretionary Spending

Discretionary spending covers all the "wants" that come after you've handled the essentials. Basically, it's whatever's left after the must-haves are paid for.

Entertainment and lifestyle costs usually eat up most of this category—think dining out, movies, streaming, hobbies, and so on.

Shopping for non-essentials is another big chunk. That's stuff like extra clothes, gadgets, home décor, and gifts.

It's up to you to divvy up your discretionary spending based on what you care about most. If travel's your thing, maybe you skip a few dinners out and stash that cash for a trip.

The 50/30/20 rule suggests about 30% of your after-tax income can go here, but if you're dealing with a lot of debt or tight finances, you might need to cut that way down.

Tracking these expenses can be eye-opening. People often realize they spend way more here than they thought, making this the easiest spot to trim if you need to tighten your budget.

Setting Financial Goals and Priorities

To really make a budget work, you need clear financial goals to guide your spending and resource allocation. Good goal setting gives you a map for meeting both your immediate needs and your future dreams.

Establishing Financial Goals

Setting financial goals starts with figuring out what's most important for your future. Goals work best when they're specific, measurable, and actually doable—otherwise, they're just wishes.

SMART Goal Framework:

- Specific: Define exact amounts and purposes

- Measurable: Include numerical targets

- Achievable: Set realistic expectations

- Relevant: Align with personal values

- Time-bound: Establish clear deadlines

Common goals? Building an emergency fund, paying off debt, saving for something big, or planning for retirement. Every goal needs a different approach and timeline.

Ranking your goals helps you decide where to focus your energy and money first. Usually, top priorities are things like emergency savings and knocking out high-interest debt.

Short-Term and Long-Term Objectives

Short-term goals usually cover a year or less and tackle immediate financial needs. Think of things like scraping together a $1,000 emergency fund, wiping out credit card debt, or stashing cash for a vacation.

Long-term goals stretch beyond a year and take more sustained effort. These might mean saving for retirement, buying a house, funding your kid's education, or hitting big investment targets.

Long-term objectives can really benefit from compound interest and steady contributions. If a 25-year-old puts away $200 a month for retirement, they'll end up with way more than someone who waits until 35 to start.

Short-term goals feel urgent and need space in your budget right away. Long-term goals, though, let you take your time and adjust as life throws curveballs.

Aligning Goals With Your Budget

Budget alignment makes sure financial priorities actually get funded without blowing up your basic expenses. It's a balancing act, no doubt, with limited resources and too many wants.

List all your goals and figure out what you need to put aside for each one every month. Stack those numbers up against your income after you've covered the basics like rent, utilities, and minimum debt payments.

Priority Allocation Strategy:

- Essential expenses (50-60% of income)

- High-priority goals (debt elimination, emergency fund)

- Medium-priority goals (retirement, major purchases)

- Low-priority goals (discretionary savings)

If your income doesn't cover it all, you'll have to boost earnings, cut back, or give yourself more time. Effective budgeting strategies help you stretch your dollars across competing needs.

Check your budget every month to see if you're making progress. Life changes, so your priorities will too, and you'll need to tweak things along the way.

Set up automation to send money straight to goal-specific accounts before you're tempted to spend. It's just easier and you'll actually stick to it.

The Budgeting Process Step-by-Step

Effective budgeting really comes down to three things: building a plan that fits your real life, actually tracking what you spend, and making changes as your habits or situation shift. These pieces work together and, honestly, it's never a set-it-and-forget-it deal.

Creating a Realistic Budget

A solid budget starts with knowing what you really bring in and spend. Dig up at least three months of bank statements and receipts to get a feel for your habits.

Most people work with monthly budgets. That's enough detail to keep tabs on things without going nuts, and it lines up with how most of us get paid and pay bills.

Essential budget categories include:

- Fixed expenses (rent, insurance, loan payments)

- Variable necessities (groceries, utilities, gas)

- Discretionary spending (entertainment, dining out)

- Savings and emergency funds

Budget with what you actually spend, not what you wish you spent. If you fudge the numbers, your budget will probably fall apart in a few weeks.

Set aside emergency fund money before you even think about fun stuff. Most experts say $500-$1000 is a good starter goal for emergencies.

Tracking and Monitoring

Track every expense, every day. Apps, spreadsheets, or just scribbling in a notebook—whatever works, as long as you record it within 24 hours.

Effective tracking methods include:

- Mobile banking apps with spending categories

- Snapping photos of receipts and logging them weekly

- Automated expense categorization tools

- Old-school notebooks for cash purchases

Check in on your budget each week for ten or fifteen minutes. Compare what you've spent to what you planned.

Do a bigger review every month. Look for categories that keep going over and notice what's working well.

Stay aware of your spending in real time. Some folks check their category balances before splurging on something non-essential—and it helps.

Review and Adjustments

Make changes to your budget every month based on what you tracked and any curveballs life throws at you. The budgeting process isn't rigid—it has to flex with you.

If your income changes, update your budget right away. Pay raises, job loss, or unpredictable paychecks mean you'll need to recalculate everything.

Common adjustment scenarios include:

- Seasonal expenses (heating, holidays)

- Big life changes (marriage, kids, moving)

- Adjusting goals (saving more, paying off debt faster)

- Shifting categories based on what you actually spend

Try not to ditch your budget just because you need to tweak it. The goal is to make it work for real life, not to be perfect.

Give your budget a serious review every three months. Patterns pop up over time, and these bigger check-ins can help you make smarter changes for the long haul.

Tools and Techniques for Enhanced Budgeting

Modern budgeting isn't just about spreadsheets anymore. Strategic methods and digital tools can really make a difference—whether you're using the 50/30/20 rule, a slick app, or old-school zero-based budgeting, the right combo can totally change your money game.

Popular Budgeting Methods

The 50/30/20 rule is still one of the easiest ways to budget. You put 50% of your income toward essentials, 30% for fun stuff, and 20% for savings and investments.

Essentials mean rent, utilities, groceries, and minimum debt payments. Discretionary spending is all the extras—dining out, entertainment, and those little treats.

The 70/20/10 rule is another option. You use 70% for everything you need and want, 20% for savings and investments, and 10% for either debt payments or giving to charity.

Pay yourself first means you stash away savings before spending on anything else. You pull out your savings right when you get paid, then budget what's left for bills and extras.

The envelope system gives each spending category its own envelope of cash. Groceries, entertainment, transportation—they all get a set amount. When the envelope's empty, you're done spending there.

This approach is super visual, but it can get tricky if you mostly use cards or digital payments.

Leveraging Budgeting Apps

Budgeting apps take a lot of the hassle out of tracking and monitoring. Apps that sync with your bank accounts sort transactions automatically and show you where your money's going.

Automated features like alerts, categorization, and goal tracking make it easier to stay on top of things. Plenty of apps will even negotiate bills or keep tabs on all your subscriptions.

Some budgeting apps also track your credit score right alongside your spending. That's handy for seeing the bigger financial picture.

Manual tracking is still alive and well—Excel or Google Sheets templates do the trick. Save your receipts and tally up totals weekly or monthly if you prefer that control.

The best thing about budgeting apps? Real-time feedback. You'll know immediately if you're close to overspending and can adjust on the fly.

Utilizing Zero-Based Budgeting

Zero-based budgeting makes sure every single dollar has a job. You subtract all your expenses from your income until there's literally nothing left unassigned.

You start with essentials, then wants, then financial goals. Any leftover cash goes to savings, debt, or wherever you decide—it just can't float around aimlessly.

Here's how you do it: figure out your total monthly income, list out every expense, and assign dollars until you hit zero. No mystery money left over.

This method helps you squeeze the most out of your income, but it does take more time and attention to detail.

Challenges? Irregular income and surprise expenses can make it tough. Folks with steady paychecks and good discipline usually get the most out of it.

Zero-based budgeting can really move the needle if you want to pay off debt or ramp up savings fast.

Overcoming Challenges and Building Financial Stability

If you want real financial stability, you've got to build safety nets, get rid of debt, and find ways to stress less about money. These aren't just buzzwords—they're the pillars of lasting financial independence.

Emergency Fund Creation

An emergency fund is your safety net. Most pros say you should aim for three to six months of living expenses in a separate, easy-to-get-to account.

Start small—it's less intimidating. Even $25-50 a month adds up. Set up automatic transfers to a high-yield savings account so you're not tempted to dip in.

Figure out your target:

- Monthly essentials × 3 = bare minimum

- Monthly essentials × 6 = ideal

- Count housing, utilities, food, transportation, and debt payments

Keep your emergency fund liquid but not too accessible. Money market or high-yield savings accounts usually beat regular savings rates and still let you grab cash in a pinch.

A common trap? Underestimating irregular expenses. Track your spending for a couple months to get a real average before deciding how much you need.

Debt Repayment Strategies

Getting rid of debt faster clears the way to independence. There are two main approaches that work for most people.

The debt avalanche method means you attack the highest-interest debt first. List debts by interest rate, pay minimums on all but the worst offender, and throw every extra cent at that one. You'll pay less overall this way.

The debt snowball method flips the script—you start with the smallest balance. Pay minimums everywhere, then hammer away at the tiniest debt for some quick wins and motivation.

If you're juggling several high-interest debts, look into consolidation. A personal loan or balance transfer card with a lower rate can simplify things and save you cash.

Whatever method you choose, stick to paying more than the minimum every month. That's how you actually make a dent.

Reducing Financial Stress

Financial stress can really mess with your head and cloud your judgment. When you set up clear systems and keep your expectations realistic, it gets a bit easier to handle money anxiety.

Automate financial decisions so you don't have to think about money every single day. I recommend setting up automatic transfers for savings, paying bills, and tackling debt.

This way, you sidestep the emotional tug-of-war that comes with routine financial chores. It just happens in the background, no drama.

Track progress visually—seriously, use charts or a good app that shows your debt shrinking or your savings stacking up. Watching those numbers move can be oddly satisfying and helps keep panic at bay.

Try scheduling a monthly 30-minute budget check-in. Take a quick look at your expenses, tweak a few categories, and maybe even pat yourself on the back for progress.

Building financial confidence is about getting clear on where your money goes and setting goals you can actually hit.

If you're sharing finances, open communication makes a world of difference. Set up a monthly money talk with your partner or family—go over goals, worries, and anything coming up soon.

Achieving Financial Independence

Financial independence happens when your passive income actually covers all your living expenses, no day job required. Getting there takes a mix of steady saving and some smart investing moves—definitely not an overnight thing.

Calculate your financial independence number: Just multiply your annual expenses by 25. That's your target investment portfolio, based on the 4% withdrawal rule, which is supposed to let you live off your investments for the long haul.

You'll want to invest consistently, not just stash cash after you've built your emergency fund or paid off debt. If your employer offers a 401(k) match, grab it—then look at maxing out IRAs or other tax-advantaged accounts.

Here's how most people tend to prioritize:

- Emergency fund (3-6 months of expenses)

- Snag your employer's 401(k) match

- Pay off any high-interest debt

- Max out your IRA

- Put more into your 401(k) if you can

- Open up taxable investment accounts

Achieving financial stability really comes down to setting goals, budgeting in a way that works for you, and sticking with smart investing for the long run.

Try tracking your net worth every month—just take your total assets and subtract your debts. Personally, I think this gives you a much clearer picture of your financial health than just looking at income or how much you're spending.

The start of a new year always feels like a fresh shot at getting your money right. It's a chance to look at how you've been spending and try some changes that could actually stick.

The holidays bring joy and connection, but let's be honest—they can bring financial headaches too. Plenty of families overspend at Christmas, and nobody wants debt hanging around in January.