Commercial cleaning products are loaded with harsh chemicals. They can irritate your skin, trigger allergies, and honestly, the costs pile up fast.

Introduction to Zero-Based Budgeting Method for Regular Households: A Complete Guide

Lots of households have trouble figuring out where their money disappears to each month. Even with a decent income, it's surprisingly easy to end up short before payday. Zero-based budgeting is a method where income minus expenses equals zero, meaning every dollar gets assigned a specific purpose before it's spent.

This approach isn't like traditional budgeting. Instead of just tracking what you spent after the fact, you have to justify and assign every dollar before it goes anywhere.

The zero-based budgeting method gives every dollar a job, whether that's paying bills, building savings, or funding entertainment, which helps households take complete control of their finances. Unlike percentage-based budgets that use fixed ratios, this system adapts to each family's unique situation and priorities.

Families can use this method to cut overspending, pay off debt faster, and build savings more intentionally. It's not magic, but it's definitely a shift in thinking.

This guide digs into the principles behind zero-based budgeting and lays out practical steps for everyday families. You'll see how to sort expenses, tweak things as life changes, and handle the usual roadblocks that make budgeting hard.

Understanding Zero-Based Budgeting

Zero-based budgeting means you assign every dollar of income to a specific category, so your budget balances to zero at the end. With this method, you start from scratch each month, not from last month's habits.

What Is Zero-Based Budgeting?

Zero-based budgeting is a method where every expense must be justified for each period, starting from a "zero base." Every dollar you earn gets assigned to a category—bills, savings, debt, you name it. Nothing is left floating around.

Here's the core idea: income minus expenses must equal exactly zero. When you get paid, you decide where each dollar goes before you spend anything. That way, nothing slips through the cracks.

Every dollar has a job in this system. Whether it's rent, savings, or groceries, you tell your money what to do. Otherwise, it just kind of disappears—doesn't it always?

Each month, you start fresh. You can't just copy last month's numbers and call it a day. You have to look at each expense and decide if it still makes sense.

How Zero-Based Budgeting Differs From Other Methods

With traditional budgeting, most people just tweak last month's numbers. Zero-based budgeting asks you to build your budget from scratch every time, justifying everything—no matter what you did last month.

Incremental budgeting just adds or subtracts a bit from last time. If you overspent on groceries, you bump it up by $50. Zero-based budgeting doesn't care what you spent before.

Percentage-based budgeting splits your income into fixed percentages, like the 50/30/20 rule. Zero-based budgeting adapts to what's actually happening in your life, not some rigid formula.

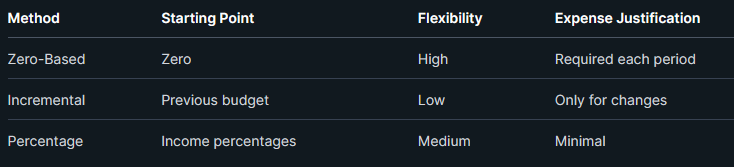

The table below highlights the differences:

Zero-based budgeting takes more effort upfront, honestly. But you get more control since you're actively deciding where every dollar goes, not just letting things run on autopilot.

Benefits of Using Zero-Based Budgeting

Zero-based budgeting helps you avoid overspending and make sure your money actually does something useful. You become way more aware of your habits and have to think about what matters most.

Improved financial control comes from tracking every dollar. You set limits for each category, so you're not left wondering where your money went at the end of the month.

Enhanced savings potential happens because you're allocating money on purpose. People usually find themselves putting more toward savings or debt once they see where the rest is going.

Reduced financial stress shows up as you get a clearer picture of your finances. Knowing where every dollar goes can really take the edge off those "uh-oh" moments when bills are due.

Better alignment with goals comes from regularly checking your spending against your priorities. Each month, you have to ask yourself what really matters—and that shapes your choices.

Core Principles of Zero-Based Budgeting

Zero-based budgeting has three key principles that really change how families handle their money. Every dollar gets a job, income and expenses must balance, and you need to review and adjust your spending regularly.

Assigning Every Dollar a Job

With zero-based budgeting, you give every dollar of income a role before the month starts. You can't just leave money unassigned and hope for the best.

Start by listing all your income for the month. Then, break it down into categories like rent, groceries, utilities, savings, or debt payments. You want nothing left unaccounted for.

Essential allocation categories include:

- Fixed expenses (rent, insurance, loan payments)

- Variable necessities (groceries, utilities, gas)

- Savings goals (emergency fund, retirement)

- Debt repayment

- Discretionary spending (entertainment, dining out)

This method makes it harder to spend impulsively because each dollar already has a job. If something unexpected comes up, you have to shift money from another category instead of just overspending.

The zero-based budgeting method requires every expense to be justified and planned ahead. It's about being intentional and making your spending match your real priorities.

Balancing Income and Expenses

The math is simple: income minus expenses must equal zero. This guarantees you're living within your means and squeezing the most out of your money.

If your expenses add up to more than your income, you've got to cut somewhere or find a way to earn a bit extra. Maybe that means less takeout, switching phone plans, or picking up a side gig.

Common balancing strategies:

- Cut back on things like eating out or streaming services

- Negotiate lower bills for insurance or utilities

- Bring in extra income if possible

- Focus on essentials first

If you have money left after covering expenses, assign it to something meaningful—like debt payoff or savings—not just random spending.

This way, you're making conscious choices about what matters most. You can't spend money you don't have, and every dollar works for you.

Regular Expense Review and Adjustment

Zero-based budgeting means you need to check and tweak your budget every month. Look at what you actually spent compared to what you planned, and make changes for next time.

This helps you spot patterns and problem areas. If groceries keep blowing the budget, you either bump up the amount or find ways to cut back.

Monthly review steps:

- Compare what you spent with what you budgeted

- See which categories went over or under

- Figure out why things didn't match up

- Adjust next month's numbers based on what you learned

- Plan for any unusual expenses coming up

The budgeting technique requires each expenditure to be reviewed and justified every period. It's a constant work-in-progress, but you get better at it over time.

By making regular adjustments, you keep your budget realistic and useful. You actually learn how you spend and can make smarter choices about where each dollar goes.

Steps to Implement Zero-Based Budgeting at Home

With zero-based budgeting, you decide where every dollar of your monthly income goes before you spend a cent. It's a process—figure out your income, sort your expenses, assign your dollars, and keep an eye on things as the month rolls along.

Calculate Total Monthly Income

You have to know what's coming in before you can budget. Write down all your regular paychecks—salary, hourly wages, and steady overtime.

Primary Income Sources:

- Base salary or hourly wages

- Regular overtime payments

- Commission earnings

- Social Security benefits

- Pension payments

Side gigs count too, but only if you can count on that money. Households should include planned earnings from freelancing or part-time work if they expect it to show up consistently.

If your income jumps around, use your lowest month from the recent past as your baseline. Anything extra can go toward goals when it comes in.

Don't forget—net income matters, not gross. Subtract taxes, insurance, and deductions to see what you really have to work with.

Identify and Categorize Expenses

Sorting your expenses into categories stops you from missing anything important. The most effective approach prioritizes essential expenses before you worry about the fun stuff.

Essential Categories (The Four Walls):

- Housing: Rent, mortgage, property taxes, HOA fees

- Food: Groceries, necessary household supplies

- Transportation: Car payments, gas, insurance, maintenance

- Utilities: Electricity, water, gas, internet, phone

Secondary Priorities:

- Insurance: Health, life, disability coverage

- Debt payments: Credit cards, student loans, personal loans

- Savings: Emergency fund contributions, retirement accounts

Some expenses change month to month. Things like entertainment, eating out, and personal care can shift depending on what's going on in your life.

Households typically experience improved financial awareness within the first month of tracking and categorizing expenses in detail. It's eye-opening, for better or worse.

Allocate Funds to Every Category

Fund allocation turns income into a plan with real intention. Every dollar gets a job before the month even starts, which takes the guesswork out of money decisions.

Allocation Priority Order:

- Giving/Charity (if that's part of your plan)

- Savings and emergency fund contributions

- Essential expenses (Four Walls)

- Insurance and debt payments

- Discretionary spending categories

Honestly, you want the math to add up. The total you allocate should match your monthly income, so you end up with that classic zero-based equation: income minus expenses equals zero.

It helps to add a miscellaneous category for those random things that pop up. This buffer saves your budget from getting thrown off by little surprises.

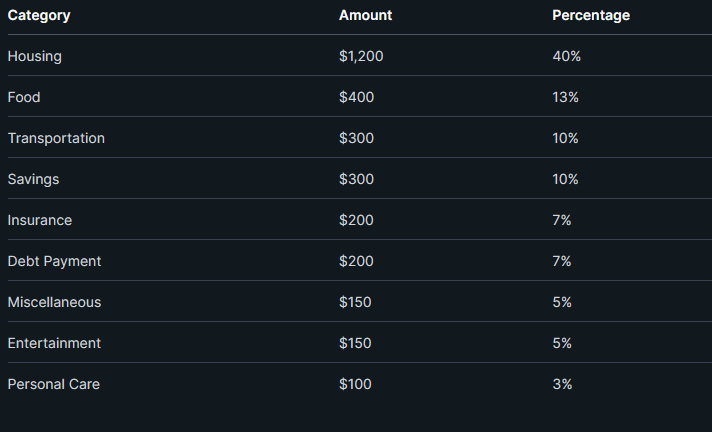

Sample Allocation Table:

Track and Refine the Budget

Tracking your budget brings it to life. Zero-based budgeting works best when you keep tabs on every transaction and stay within your set limits.

Daily Tracking Methods:

- Mobile budgeting apps

- Spreadsheet updates

- Written expense logs

- Bank account monitoring

Things change month to month, so you'll want to tweak your categories if your real spending doesn't match your plan. The zero-based principle still stands, but you can move things around as life happens.

Refinement Indicators:

- Spending more than expected in certain categories

- Leaving money unused

- Seasonal changes in expenses

- Income shifts or irregular paychecks

Some expenses—like utilities—seem to have a mind of their own and jump around with the seasons. Entertainment costs can spike during the holidays or special events.

Every month really needs its own budget that reflects what's coming up, whether it's irregular bills or a change in income. This monthly reset keeps things relevant and stops your budget from going stale.

Essential Expense Categories for Households

Zero-based budgeting makes you give every dollar a purpose across four key types of expenses. You've got your fixed must-pays, your variable costs that bounce around, and those dedicated savings and debt payments that keep your future on track.

Fixed Costs and Obligations

Fixed costs are those bills that just don't budge. They're the backbone of your budget, so you have to handle them first.

Housing costs usually eat up the biggest chunk of your paycheck. Rent or mortgage, property taxes, and home or renters insurance all land here. Most experts say to keep this under 30% of your gross income, though that's easier said than done in some areas.

Insurance premiums help you avoid big financial hits. Health, auto, and life insurance all fall into this bucket. These payments barely change, so you can plan for them month after month.

Debt payments with fixed amounts—think student loans, car loans, or the minimum on your credit cards—also go here. Missing them tanks your credit score and racks up fees, so don't skip them.

Utility base charges and subscriptions round out the fixed stuff. Your phone plan, internet, and streaming services are usually pretty steady, so you can count on those numbers.

Variable and Irregular Expenses

Variable expenses are the wild cards—necessary, but never quite the same twice. You'll want to keep an eye on these and use your past spending to set a realistic budget.

Groceries are the heavyweight here for most families. Food costs swing with meal plans, diets, and even the seasons. Tracking a few months helps you nail down a good average.

Transportation costs past your car payment include gas, public transit, parking, and maintenance. Gas prices alone can make this category unpredictable.

Utilities that get billed by usage—like electricity, gas, and water—change all the time. Good budgeting strategies can help smooth these out, but you'll still see ups and downs.

Personal care covers things like clothes, haircuts, medical copays, and pharmacy runs. These pop up randomly but are pretty much unavoidable.

Savings and Debt Payments

Savings and extra debt payments move you forward financially. Zero-based budgets give these a real spot in your plan, not just leftovers.

Emergency fund contributions guard you from the unexpected. Most pros suggest saving three to six months of living expenses, which sounds huge but gets easier with steady monthly deposits.

Debt payment acceleration knocks out high-interest debt faster. Zero-based budgeting treats savings and debt as regular bills, so you're less likely to skip them.

Retirement savings—whether through work or your own account—can quietly build up over time. Even small monthly amounts add up if you stick with it.

College savings for kids takes early action and consistency. With tuition rising, setting aside money each month really matters for families with students.

Sinking Funds and Future Goals

Sinking funds are your secret weapon for big, irregular expenses. By saving a bit each month, you avoid scrambling when these costs hit.

Vehicle maintenance and replacement funds keep you ready for repairs or a new car down the road. Most cars need big fixes eventually, so it's smart to plan ahead.

Home maintenance is another one. Stuff breaks—roofs, appliances, HVAC systems—and it's never cheap. Sinking funds let you handle it without panic.

Holiday and gift funds spread out the pain of birthdays, Christmas, and vacations. You don't want December to wipe out your budget, so saving all year helps.

Annual expenses—like insurance premiums, property taxes, or memberships—are way less stressful when you've been setting money aside every month.

Adapting to Changing Financial Situations

Zero-based budgeting really shines when life throws curveballs. Since you give every dollar a job each month, you can shift things quickly if your income drops, surprise expenses show up, or your priorities shift.

Managing Fluctuating Income

If your income jumps around—maybe you work seasonally, rely on commissions, or freelance—zero-based budgeting helps you start fresh each month instead of guessing based on last month's spending.

Income prioritization gets vital when things are tight. You cover the essentials first—housing, utilities, food—and cut or shrink the rest if you have to.

Folks living paycheck to paycheck often find this approach useful when their income isn't steady. You can make a few different budget plans:

- Minimum income budget: Just the must-haves

- Average income budget: Some extras allowed

- High income budget: More savings and maybe some splurges

If you're an irregular earner, check your lowest income month from the past year. Build your baseline budget off that number so you always cover the basics. Any extra in better months can go to savings, debt, or other goals.

This method makes you think before you spend during windfall months, instead of just letting money slip away.

Coping With Unexpected Costs

Emergencies will test any budget's flexibility. Zero-based budgeting lets you shuffle things around without blowing up your whole plan.

When surprise bills hit, you can spot variable expenses to cut or pause—think dining out, entertainment, or subscriptions—and redirect that money to whatever's urgent.

Immediate response steps look like this:

- Pin down the exact emergency cost

- Scan your current allocations for wiggle room

- Move money from non-essentials

- Update the rest of the month's budget

Car trouble, medical bills, or home repairs often force these changes. Zero-based budgeting keeps the process clear—you see exactly where the money comes from.

Emergency fund integration fits right in. If you dip into your savings, you can put rebuilding it at the top of next month's priorities.

Adjusting for New Financial Goals

Life changes—new house, kids, career moves—mean new goals. Zero-based budgeting lets you work these in without missing a beat.

Goal integration process starts with the math. Want a $12,000 emergency fund in a year? That's $1,000 a month, and you treat it just like any other bill.

Priority ranking comes into play when you can't do it all at once:

- High priority: Emergency fund, high-interest debt

- Medium priority: Retirement, moderate debt

- Lower priority: Vacations, splurges

You'll want to review income and expenses each month to keep up with changing priorities. Big life events—marriage, kids, job switches, retirement—will all shake things up.

This approach forces you to pick your battles, so you actually make progress on what matters most instead of spinning your wheels.

Zero-based budgeting flexes with your life—whether your income is up, down, or sideways, or your goals keep evolving. The monthly reset makes it easier to pivot without ditching your system.

Popular Tools and Resources for Zero-Based Budgeting

These days, there are tons of apps, spreadsheets, and online communities to help you stick with zero-based budgeting. You don't have to go it alone—there's plenty of support out there if you want to dive in.

Budgeting Apps and Software

YNAB (You Need A Budget) is probably the most popular zero-based budgeting app out there. It asks you to assign every dollar before you spend it, sticking with the idea that every dollar has a specific job.

It costs $14.99 a month, but you can try it free for 34 days. You can sync your bank accounts, set up spending categories, and watch your progress update in real time.

EveryDollar has a free version where you enter transactions manually, plus a premium option that connects to your bank. The layout looks a lot like traditional zero-based budgeting worksheets, so beginners usually find it pretty easy to use.

Mint gives you free budgeting tools and automatically sorts your spending. It's not built just for zero-based budgeting, but you can tweak categories to make the zero-balance thing work.

Personal Capital mainly focuses on investment tracking, but it has budgeting features too. The free version can work well if you want to keep an eye on both your budget and your investments at the same time.

Spreadsheet Templates and Printables

Excel and Google Sheets templates let you build a zero-based budget that fits your life. Some people like spreadsheets because they can control every category and tweak the formatting however they want.

Popular templates usually have automatic math, monthly tracking pages, and breakdowns by expense type. You can find plenty of free templates on personal finance blogs and budgeting sites.

Printable worksheets are great if you prefer using pen and paper. Most include places for income, expenses, and calculating your balance.

Lots of templates blend the envelope method with zero-based budgeting. That combo helps you actually see your spending limits for every category.

Digital templates often throw in charts and graphs so you can watch your progress. Some even have debt payoff calculators or savings goal trackers if you want to get fancy.

Community Support and Learning Resources

Reddit communities like r/YNAB and r/personalfinance are pretty active with daily support for people using zero-based budgets. Folks share templates, swap stories, and help each other troubleshoot.

Facebook groups focused on certain budgeting apps give you targeted advice. Sometimes they even host live Q&A sessions with people who've been at this for years.

YouTube channels are loaded with visual guides for setting up zero-based budgets. Many creators post monthly reviews and share their own tips for optimizing categories.

Personal finance blogs are always putting out new guides and case studies about zero-based budgeting. A lot of them include checklists or step-by-step plans you can download.

Podcasts with budgeting experts are perfect for learning while you drive or do chores. Some shows bring on families who've actually made zero-based budgeting work, which is always inspiring.

Common Challenges and Pro Tips for Success

Zero-based budgeting takes discipline, and honestly, it can be tough to stick with at first. Building habits, spotting your spending triggers, and making sure your daily choices line up with your bigger goals all matter a lot.

Staying Consistent and Motivated

Sticking with zero-based budgeting is hardest when your motivation starts to dip. Most people kick things off with energy but lose steam after a couple of months, usually because tracking everything can feel like a chore (see why here).

Weekly review sessions help keep you honest. Try blocking off 15 minutes every Sunday to check your budget and tweak categories—otherwise, little overspends can pile up fast.

Visual progress tracking is surprisingly motivating when things get tough. A simple chart showing your debt going down or your savings going up can really boost your mood. Marking off finished goals gives you momentum to keep going.

The buddy system makes a difference. If you share your budgeting goals with a friend or family member, you're about 65% more likely to stick with your spending limits.

Celebrating small wins matters, too. When you finish your first month on a zero-based budget, treat yourself to a little reward—just make sure it fits in your entertainment category!

Overcoming Overspending Traps

Impulse buys are the enemy of zero-based budgeting. Since the system is pretty strict, you have to stay aware of your spending or things can get out of hand fast.

The 24-hour rule is a lifesaver for avoiding impulse purchases. If you want something that's over $50 and it's not essential, wait a full day before buying. Most of the time, you'll decide you don't need it after all.

Cash envelope method works wonders for stuff like groceries or entertainment. If you only bring the cash you budgeted, you physically can't overspend in those categories.

Setting up an emergency buffer category helps you handle surprises without blowing up your budget. Tossing $100-200 a month into a "miscellaneous" bucket keeps things flexible but still structured.

Spending triggers are sneaky, so you've got to know yours. Stress, social events, and big sales catch a lot of people. Having a plan—like calling a friend instead of shopping when you're stressed—makes a real difference.

Get rid of store credit cards and turn off one-click buying if you can. Making it harder to spend impulsively can save you from a lot of regret later.

Optimizing for Long-Term Financial Health

Zero-based budgeting really shines when you're working toward specific financial goals. The trick is to keep adjusting your budget categories as your life and priorities change.

Automated savings transfers make it easier to stay on track. Just set up automatic transfers on payday, and you'll sidestep the urge to spend what you meant to save or invest.

Debt avalanche strategy fits nicely with zero-based budgeting. Focus extra payments on your highest-interest debt, and keep making minimums on the rest.

Once you pay off one debt, roll that payment into the next highest-interest one. It's a cycle that gains momentum over time.

Annual budget reviews help you recalibrate when life throws changes your way. If your income goes up, your family grows, or you set new goals, it's time to rethink your budget.

Building a three-to-six-month emergency fund should come before tackling debt aggressively or ramping up investments. This buffer keeps your budget intact when emergencies happen.

Percentage-based allocations give you a structure that flexes as your income shifts. Plenty of folks stick to the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings or debt payoff. You can adjust the actual amounts, but keeping those ratios helps.

Learning about personal finance on a regular basis definitely pays off. Maybe read a financial book every few months or sign up for an online course—either way, it's a smart way to make better decisions about your money and future.

The start of a new year always feels like a fresh shot at getting your money right. It's a chance to look at how you've been spending and try some changes that could actually stick.

The holidays bring joy and connection, but let's be honest—they can bring financial headaches too. Plenty of families overspend at Christmas, and nobody wants debt hanging around in January.