Growing fresh herbs, veggies, and flowers in your apartment? Totally doable, even if you're short on space. Starting a mini apartment garden might actually save you some cash on groceries—especially with herbs and salad greens—but your setup costs and plant choices will shape how much you save.

The Psychology of Impulse Buying: How to Spot & Overcome It

Most people spend more than $280 every month on unplanned purchases. What looks like a harmless shopping run can quietly drain your finances faster than you'd expect.

Impulse buying hits almost everyone. About 89% of shoppers admit to making at least one impulse buy in the past month, and more than half have spent $100 or more on a single unplanned item.

The brain's emotional reward centers often clash with rational thinking when you're tempted to buy something on a whim. Stress and fatigue? They tend to tip the scales toward "just buy it."

Retailers know exactly what they're doing. They set up stores with scarcity messages, clever product placement, and subtle environmental cues that can make even the most disciplined shopper slip up.

There are proven ways to fight back against these tactics and your own impulses. Waiting periods, mindfulness, and paying attention to your emotional state can help you keep your money where it belongs—in your wallet and working toward your real financial goals.

Key Takeaways

- Impulse buying comes from a tug-of-war between your brain's reward centers and rational thinking

- Stores use psychological tricks, like scarcity and environment, to nudge you toward unplanned buys

- Waiting before buying, practicing mindfulness, and recognizing your triggers can cut impulse spending by up to 30%

Understanding Impulse Buying

Impulse buying hits 89% of people every month, costing the average person over $280 in unplanned spending. It's not the same as just being spontaneous; it can have real consequences for your wallet.

Defining Impulse Buying vs. Spontaneous Purchases

Impulse buying means grabbing something you didn't plan for, usually because you're caught up in the moment. You don't really think about whether you need it or if it fits your budget.

When you suddenly want to buy something you just noticed, that's impulse buying. Emotions like excitement, boredom, or stress often trigger this urge, not any real shopping plan.

Spontaneous purchases might also be unplanned, but you at least pause and ask yourself if it's useful or worth the price. There's a bit of logic in the mix.

Some key differences:

- Decision time: Impulse buyers act right away, while spontaneous buyers pause for a second

- Emotional state: Impulse buying comes from strong emotions; spontaneous buying is more chill

- Regret levels: Impulse buys often lead to regret; spontaneous ones, not so much

Prevalence and Impact on Financial Health

On average, people spend over $280 a month on impulse buys. That adds up to more than $3,300 a year.

Nearly nine out of ten shoppers admit to at least one impulse buy every month.

Impulse spending doesn't just drain your bank account in the moment. People who shop on impulse rack up 40% higher credit card balances than those who stick to a plan.

Financial health takes a hit in a few ways:

- Emergency savings shrink

- Debt starts piling up

- It gets harder to cover essentials

- Retirement savings often get the short end of the stick

More than 40% of shoppers say impulse buys have caused them financial stress. That stress, in turn, just makes future impulse shopping more likely.

Most impulse purchases still happen in brick-and-mortar stores—about 80% of them. But online impulse shopping is catching up fast, thanks to one-click checkouts and those annoyingly accurate ads that follow you around.

The Psychological Triggers Behind Impulse Buying

Impulse buying happens when our brains let emotions and cravings for quick rewards take the wheel. The regret that follows? It's all part of the cycle.

Emotional Triggers and Emotional Spending

Emotions are usually the spark for those "I have to buy this now" moments. Stress, excitement, boredom, sadness—pick your feeling, and you've probably shopped because of it.

Stress shopping is everywhere. When stress levels rise, so does the urge to buy something, anything, just to feel better. Shopping becomes a quick escape from a bad mood.

Good moods can also make us spend. When we're happy or celebrating, we're way more likely to treat ourselves, sometimes without thinking.

Mood regulation sneaks into our shopping habits more than we realize. We buy things to stay happy or to chase away a funk, even if we know better.

The limbic system—the brain's emotional HQ—basically hijacks rational thinking in these moments. That's why we sometimes buy stuff we know we shouldn't.

Instant Gratification and the Brain's Reward System

Our brains crave the rush of a reward, and shopping delivers. Retailers have figured out exactly how to push those dopamine buttons.

Dopamine actually spikes before we even buy something, just from the anticipation. That pleasure hit makes it tough to wait or think things over.

The prefrontal cortex, which normally helps us make smart decisions, gets quieter when the reward system fires up. No wonder our logic goes out the window at checkout.

Shopping online makes instant gratification even easier. One-click purchases, saved cards, and fast shipping all feed that need for immediate satisfaction.

Every time we buy on impulse, the brain strengthens the connection between shopping and pleasure. That's why it's so easy to fall into the habit again and again.

Buyer's Remorse and Regret

Regret usually shows up after the thrill of an impulse buy fades. That's when reality—and sometimes guilt—kicks in.

Cognitive dissonance pops up when we realize a purchase doesn't fit our values or goals. It's uncomfortable, and sometimes we try to justify it by buying even more.

Shame and guilt can creep in, especially after big or unnecessary splurges. Ironically, those feelings sometimes push us to shop again, hoping to feel better.

Financial stress just piles on when our budgets take a hit. That anxiety can set off another round of impulse buying, keeping the cycle spinning.

Environmental and Social Influences

The world around us—stores, ads, even friends—shapes what we buy, often more than we realize. Environmental and social factors play a huge role in impulse buying, no matter who you are or where you shop.

Marketing Tactics and Product Placement

Retailers put items in your path on purpose, hoping you'll grab them without thinking. Ever notice all those little things near the checkout? That's no accident.

High-impact placement zones:

- Eye-level shelves for pricier stuff

- Endcaps for hot deals

- Big displays up front for seasonal or new items

- Products grouped together so you'll buy more than you meant to

The shopping experience is all about how we interact with our environment. Discounts look better when we see the original price next to the sale price—it's classic price anchoring.

Countdowns and "limited time only" signs create fake urgency. Bundle deals tempt us to pick up extras we didn't even want five minutes ago.

Online, it's all about personalized suggestions. Ads chase us around the internet, making it tough to forget about that thing we almost bought.

Store Layouts and Environmental Cues

Store design quietly nudges us into buying more. Groceries put essentials like milk way in the back, so we walk past dozens of temptations first.

Environmental tricks stores use:

- Lighting: Bright lights boost energy and speed up decisions

- Music: Slow songs make us linger (and buy more)

- Scents: Good smells put us in a spending mood

- Colors: Warm tones make us feel excited—perfect for shopping

Atmosphere matters way more than we think. Wide aisles let us browse comfortably, while cramped ones make us hurry up.

Stores tweak the temperature to keep us comfortable and maybe even a bit more social. Warmer spaces can make us more open to suggestions.

Floor patterns and the placement of carts or baskets guide us straight to the high-margin stuff. It's all designed to make shopping (and spending) feel easy.

Influencers, Social Media, and FOMO

Social proof really shapes our buying habits, especially when we see others making similar choices. Online reviews and ratings give potential buyers instant validation—sometimes a little too instant.

Social influence mechanisms:

- Celebrity endorsements and influencer partnerships

- User-generated content showcasing products in use

- "Trending now" labels and popularity indicators

- Real-time purchase notifications from other customers

Fear of missing out significantly influences buying behavior, especially for younger folks. Flash sales and those exclusive member offers really play into this psychological trigger.

Social media platforms crank up FOMO with targeted ads and peer sharing. Instagram shopping lets you buy stuff without ever leaving the app—dangerous, honestly.

Reference groups and peer influence represent major social factors in impulse buying. People often buy things just to fit in or keep up with their social circles.

Limited edition drops create this weird sense of exclusivity. Countdown timers on websites push urgency, even if there's no real scarcity at all.

Cognitive Biases and Spending Patterns

Mental shortcuts and certain psychological tendencies can totally distort our decisions, leading to those unplanned buys we sometimes regret. Fear-based triggers make this even worse, especially during uncertain times or when things seem scarce.

Cognitive Biases Shaping Purchases

Cognitive biases significantly affect decision-making processes and can pull shoppers away from rational judgment. These patterns make people lean on mental shortcuts instead of actually thinking things through.

Anchoring bias happens when you get stuck on the first price you see. A $200 jacket marked down to $100 feels like a steal, even if you could get a similar one for $80 elsewhere.

Confirmation bias makes people seek out info that supports what they already want. If someone's eyeing expensive headphones, they'll zero in on glowing reviews and just ignore the bad ones.

The scarcity principle ramps up urgency with limited-time offers or those "low stock" pop-ups. Retailers love tossing out phrases like "only 3 left" to nudge you into buying now.

Social proof shapes our choices with customer reviews, bestsellers, and those popularity badges. High ratings and big purchase numbers send the message: "Hey, lots of people love this!"

Brand loyalty and consumer preferences become influenced by confirmation bias and anchoring, so people fall into shopping habits that favor impulse over careful thought.

Loss Aversion and Panic Buying

Loss aversion makes losing something feel twice as bad as gaining it feels good. That's why people snap up deals or products so quickly when they sense they might miss out.

Fear of missing out (FOMO) gets even stronger during flash sales or limited releases. Shoppers feel real anxiety about losing out, so they buy fast—sometimes too fast.

Panic buying is basically loss aversion on steroids. During shortages or crises, people start stockpiling way more than they need. Remember the 2020 toilet paper madness? Classic case of fear of scarcity overriding logic.

Retailers take advantage of loss aversion with countdowns, stock alerts, and exclusive offers. Messages like "sale ends in 2 hours" create fake urgency that skips over rational thinking.

Status quo bias makes it even harder to change course after an impulse buy. Once someone buys on a whim, they'll often justify it instead of admitting it might've been a mistake.

Online Shopping and Digital Persuasion

Digital platforms use all sorts of sneaky psychological tricks to play on our biases and emotions, making spontaneous purchases way too easy. Payment tech strips away the old friction points that once gave us a moment to think twice.

Flash Sales, Countdown Timers, and Personalized Offers

Online sales events trigger buying frenzies by cranking up artificial urgency. Flash sales tap into FOMO by presenting those "blink and you'll miss it" deals.

Countdown timers light up the scarcity part of our brains. Seeing "Only 2 hours left" or "3 items remaining" hijacks our logic and makes us feel like we have to act now or lose out.

Personalized offers are next-level manipulation. Retailers dig through your browsing and purchase history, then serve up deals that feel weirdly relevant. Consumers with low self-control perceive targeted advertisements as more relevant, so they're especially at risk for these tailored tactics.

Limited-time offers hit several psychological buttons at once—scarcity, urgency, and the sense that you're getting special treatment. "Exclusive 24-hour sale" messaging makes you feel picked, and honestly, who doesn't like feeling special?

The Ease of Credit Cards and Digital Payments

Digital payments wipe out the old pain points of spending money. When you pay cash, you feel the loss. With cards or mobile payments, it's just numbers on a screen—almost too easy.

One-click purchasing removes that final "are you sure?" moment. Amazon's system lets people buy before their rational brain even gets a chance to weigh in. It's all about speed and convenience, not caution.

Stored payment info makes it even easier. When your card's saved in your browser or app, you can buy stuff in seconds instead of minutes.

Buy now, pay later services make spending feel painless. You get the product now but don't have to think about the cost until later, when the excitement's faded and reality sets in.

Digital wallets and tap-to-pay options add even more psychological distance. The old act of handing over cash or signing a receipt gave you a pause—modern systems smooth all that away on purpose.

How to Beat Impulse Buying with Mindful Strategies

Breaking free from impulse buying isn't easy, but it's doable with some deliberate effort. Mindful consumption strategies help people recognize their motivations and make more intentional choices.

Mindfulness and Mindful Spending

Mindfulness strengthens the prefrontal cortex, the part of your brain that handles self-control and decision-making. Research shows mindfulness exercises reduce unplanned online purchases by 25% over eight weeks, which is honestly impressive.

If you feel the urge to buy, try pausing for five deep breaths. It sounds simple, but it gives your rational mind a chance to catch up with your emotions.

Key mindfulness techniques include:

- Body scan awareness: Notice physical sensations like a racing heart or tense shoulders

- Emotional labeling: Name the feeling behind your urge (stress, boredom, excitement—whatever it is)

- Present moment focus: Ask yourself, "What am I actually feeling right now?"

Try building a quick waiting ritual before buying anything non-essential. Just observe your emotions without judging them—the urge to buy often fades on its own after a few minutes.

The 24-Hour Rule and Shopping Lists

The 24-hour waiting period cuts impulse purchases by over 30% for high-value items. That delay gives your emotional brain time to chill out while your logical side weighs in.

Add stuff to your cart or write it down, then walk away. You might find that what felt like a must-have today seems pointless tomorrow.

Shopping lists reduce unplanned purchases by nearly 40%. Some solid list strategies:

- Write down specific items and quantities

- Set a time limit for shopping trips

- Check off items as you go

- Stay away from aisles or pages that aren't on your list

Digital lists work for online shopping too. Bookmark things in a "maybe later" folder instead of buying right away.

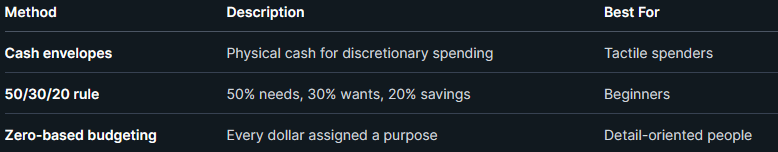

Budgeting Tools and Budgeting Apps

Automated budgeting creates financial boundaries before emotions take over. Setting up auto-transfers to savings pulls money out of reach for impulse buys.

Effective budgeting approaches include:

Budgeting apps help track where your money goes and spot impulse triggers. Mint, YNAB, and PocketGuard are popular for automatic categorization.

Having a separate "fun money" account with a set limit helps too. Once it's gone, no more splurges until the next cycle—kind of like self-imposed tough love.

Building Healthy Spending Habits

Paying with cash instead of cards reduces spending by up to 18% because you actually feel the money leaving your hands. The "pain of paying" is real.

Try keeping a spending diary to spot your personal triggers. Maybe you shop after work stress or out of boredom on weekends—everyone has their patterns.

Healthy habit substitutions:

- Stress → Take a 10-minute walk or stretch

- Boredom → Call a friend or read something fun

- Sadness → Write in a journal or listen to music

- Celebration → Cook a special meal or check out a free event

Changing your environment helps, too. Unsubscribe from promo emails, delete shopping apps, and avoid browsing retail sites when you know you're vulnerable.

Accountability partners or regular financial check-ins can keep you honest. Reviewing your purchases every so often helps reinforce good habits and spot areas for improvement.

Managing Emotional Spending and Seeking Support

Breaking the emotional spending cycle starts with recognizing your triggers and building solid support systems. Sometimes, professional guidance and clear financial goals make all the difference for lasting change.

Identifying Financial Stress and Emotional Triggers

Financial stress often pushes people toward retail therapy as a coping mechanism. Sadness, anxiety, depression, boredom, or just feeling out of control—these are some of the usual emotional triggers.

It's worth tracking spending patterns alongside emotional states. A simple daily log that notes your mood and purchases can reveal some surprising connections between feelings and financial decisions.

Key emotional triggers that lead to impulse purchases:

- Stress from work or relationships

- Social comparison and jealousy

- Loneliness and isolation

- Low self-esteem episodes

- Celebration or reward-seeking

Physical symptoms like sleep problems, headaches, or digestive issues often show up with financial stress. If you notice these, it's probably a sign your spending could spiral.

Building awareness around emotional spending patterns can give you a chance to pause before an impulsive purchase. Recognizing the pattern is honestly half the battle.

The Role of Therapy and Accountability

Professional therapy can really help when emotional spending starts causing problems. Mental health counselors dig into the psychological roots behind those spending habits.

Compulsive buying sometimes crosses into addiction territory. At that point, it needs a more specialized approach, and therapists who understand behavioral addictions know how to tackle it.

Therapeutic approaches for emotional spending:

- Cognitive-behavioral therapy (CBT)

- Mindfulness-based interventions

- Group therapy sessions

- Financial therapy specialists

Accountability partners can be a lifeline between therapy sessions. A trusted friend or family member might help keep an eye on spending decisions or even suggest something else to do instead of shopping.

Some people join support groups for shopping addiction, and honestly, that sense of community can be a game-changer. Swapping stories helps cut the shame and builds real-world coping strategies.

Financial advisors add another layer of support by helping set up spending plans. They work with you to create budgets that actually leave a little room for the occasional emotional splurge.

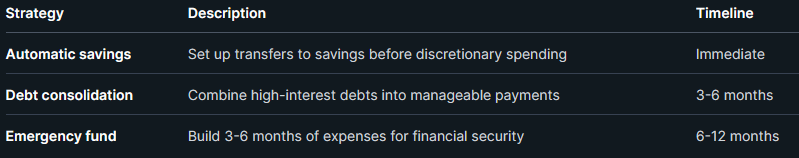

Long-Term Financial Goals and Recovery

Clear financial goals can redirect your energy away from impulsive spending. When you've got a specific target—like building an emergency fund or knocking out some debt—it suddenly feels a lot easier to say no to random purchases.

Recovery from emotional spending means finding healthier ways to cope. Exercise, creative hobbies, or just hanging out with friends can boost your mood without emptying your wallet.

Effective long-term strategies include:

Set up automatic transfers to move money into savings before you can spend it. With less cash sitting in your checking account, those impulse buys get a lot trickier.

Try doing regular financial check-ins—monthly reviews can keep you on track. It's a good way to stay accountable and spot real progress, even if it's just a little at a time.

Thrift stores give you the chance to score unique stuff without breaking the bank or adding to landfill waste. Still, walking into a second-hand shop for the first time can feel like information overload—aisles packed, shelves overflowing, and you're not sure where to even start.

Home bartending has changed a lot lately. What used to be a casual hobby now brings cocktail culture right into the living room.

4 European Destinations for a Cheap Winter Holiday: Budget-Friendly Escapes for Cold Weather Travel

Winter travel in Europe doesn't have to drain your bank account. Plenty of destinations let you soak up culture, history, and all the cozy cold-weather vibes—without those sky-high summer prices.

People often think minimalism means shelling out for fancy organizers or trendy storage bins. That belief keeps a lot of folks from even trying to simplify—and honestly, it's just not true.

Most of us pay attention to our big-ticket expenses, but those sneaky, recurring charges? They slip by almost unnoticed every month. Hidden costs can quietly drain hundreds or even thousands of dollars a year from your budget—70% of consumers underestimate their monthly recurring charges.