Growing fresh herbs, veggies, and flowers in your apartment? Totally doable, even if you're short on space. Starting a mini apartment garden might actually save you some cash on groceries—especially with herbs and salad greens—but your setup costs and plant choices will shape how much you save.

Unexpected Hidden Costs in Everyday Life: How to Spot and Avoid Them

Most of us pay attention to our big-ticket expenses, but those sneaky, recurring charges? They slip by almost unnoticed every month. Hidden costs can quietly drain hundreds or even thousands of dollars a year from your budget—70% of consumers underestimate their monthly recurring charges.

These little expenses hide out in subscriptions, bank fees, unused memberships, and everyday habits that don't seem like much on their own. But they add up.

Spotting these drains isn't always easy, and they can chip away at your savings goals before you realize what's happening. Hidden expenses sneak up on you, whether it's a streaming service you forgot about or energy vampires sucking power from plugged-in devices.

Overdraft fees, extended warranties, impulse buys triggered by emails, and delivery charges—these are the main culprits. They don't seem like much at first, but they pile up.

Key Takeaways

- Hidden monthly expenses like subscriptions, bank fees, and unused memberships can cost households hundreds of dollars annually without their awareness

- Common financial drains include energy vampires, delivery fees, impulse purchases, and automatic renewals that accumulate over time

- Regular audits of bank statements and subscription services help identify and eliminate unnecessary expenses to improve budget control

What Are Hidden Costs in Everyday Living?

Hidden costs are those expenses you don't really see coming when you make a purchase or sign up for something. They sneak in through maintenance fees, service surcharges, and subscription renewals, quietly chipping away at your spending and sometimes threatening your financial security.

How Hidden Costs Add Up in Daily Life

Everyday transactions are full of fees you probably don't even notice. Credit card processing fees? You pay them through higher prices, whether you realize it or not.

Banks love their monthly maintenance charges, and they slip onto statements where most people never look. Subscription services bump up your rates after those promotional periods end, but do they ever really tell you?

Streaming platforms, gym memberships, software licenses—they all seem to get more expensive, often without a clear heads-up. It's almost sneaky.

Common daily hidden expenses include:

- ATM fees when using out-of-network machines

- Delivery charges and service fees on food orders

- Processing fees for online bill payments

- Premium charges for expedited shipping

Hidden costs creep into everyday expenses through tiny fees that don't seem like much—until you add them up. A $3 ATM fee twice a week is $312 a year. Ouch.

Small, recurring charges pack a punch over time. Phone insurance at $15 a month? That's $180 a year you could put toward something better.

Why Hidden Charges Drain Your Wallet

Surprise fees can throw off your budget, creating expenses you never planned for. Late payment penalties on credit cards average $32 a pop, and they can even hike up your interest rate.

Overdraft fees are especially brutal. Banks charge about $35 every time your account dips below zero, and if you make a few transactions in a day, you could get hit multiple times.

Financial impact of common hidden charges:

Insurance policies bring their own set of surprises—deductibles, co-pays, facility fees, specialist charges, and prescription costs. Health insurance might cover the basics but still leave you with a hefty bill.

The average American homeowner faced over $21,000 in concealed expenditures in 2025. That's money you could use for essentials or saving up for something that actually matters to you.

The Psychology Behind Overlooked Expenses

People get used to recurring charges because automation makes them easy to ignore. Direct debits mean you don't have to think about it, so you don't notice when costs creep up or when you're paying for stuff you don't use.

That "set it and forget it" mindset keeps you from reviewing what you're actually paying for. It's no wonder gym memberships and streaming services keep getting paid for even when you're not using them.

Retailers know how to get you, too. They bundle hidden fees with things you want—extended warranties, shipping insurance, premium support—right at checkout, when you're just trying to finish your purchase.

Psychological factors that mask hidden costs:

- Anchoring bias: High initial prices make fees seem reasonable

- Loss aversion: Fear of losing services prevents cancellations

- Convenience preference: Automatic payments reduce scrutiny

- Decision fatigue: Complex fee structures discourage analysis

If you start noticing these hidden costs, you might just get smarter with your money. Sometimes, your emotions and habits take over, and logic goes out the window. Reviewing your accounts regularly can help you catch charges that don't serve you anymore.

Mental accounting makes small fees feel harmless. A $5 monthly charge seems like nothing, but would you pay $60 all at once for the same thing? Probably not.

Common Hidden Costs and Where They Lurk

Hidden expenses pop up in all sorts of places. You lose money to forgotten subscriptions, sneaky bank fees, and utility bill charges buried in the fine print.

Recurring Subscription Services and Memberships

Subscriptions are probably the biggest leak in most budgets these days. The average household pays for a dozen subscriptions but only uses half of them. That's a lot of wasted cash.

Streaming platforms love to turn free trials into automatic payments. People sign up for Netflix, Spotify, or Adobe Creative Suite, and then those charges just keep coming.

Fitness memberships can be a trap, too. Gyms charge $20-60 a month, plus initiation fees that can range from $50 to $200. And good luck canceling without a fight.

Credit card statements don't make it easy to spot these patterns. Those $9.99 or $14.99 charges blend right in, so it's easy to miss them.

Apps and digital services multiply like rabbits on your bank statement. Cloud storage, productivity tools, gaming subscriptions—they sneak in before you know it.

Subscription management tools like Rocket Money can help you track these charges. They connect to your bank accounts and flag recurring payments automatically. Pretty handy, honestly.

Banking Fees and ATM Withdrawals

Banking fees are relentless. ATM withdrawal fees run $2-5 each time you use an out-of-network machine. That adds up fast.

Overdraft fees hit hard when your account balance drops. Banks charge $25-35 every time, and if you're unlucky, several transactions in a day can rack up a pile of fees.

Monthly maintenance fees can sneak onto your checking account if you don't keep a minimum balance. These range from $5-15 a month, and sometimes they tack on extra for paper statements.

Foreign transaction fees are another one to watch out for. Credit cards usually charge 2.5-3% for purchases in foreign currency, even if you're just shopping online from an overseas retailer.

Wire transfers? Those cost $15-30 for domestic and $35-50 for international sends. Some banks even charge you to receive a wire.

Account closure fees are a nasty surprise for anyone switching banks. Some places charge $25-50 if you close the account within a few months of opening.

Unexpected Fees in Utility Bills

Utility bills are loaded with extra line items you probably never read. Delivery fees, regulatory charges, and infrastructure assessments can add 20-40% to your base rate.

Electric bills often include distribution charges on top of what you pay for energy. These cover power line maintenance and grid costs—sometimes 30% of your total bill.

Water utilities tack on sewer fees, stormwater charges, and meter reading fees. Municipalities love to add waste management and environmental compliance costs, too.

Natural gas bills bring franchise fees, pipeline safety charges, and weather adjustment factors. These can swing up or down each month, depending on regulations and demand.

Late payment fees come if you're even a little behind—usually $5-25 for overdue accounts, plus possible reconnection fees that can hit $50-150.

Paper billing fees run $1-3 a month, since utilities want you to go digital. If you need a meter reading or repair, service calls can cost $25-75 per visit.

Hidden Grocery and Shopping Expenses

Grocery shopping is sneakier than it looks. Beyond the basics, you end up paying for spontaneous checkout buys, premium add-ons, and service fees from delivery apps.

Impulse Purchases at the Store

Retailers love to position tempting items all over the store, hoping you'll make unplanned purchases. Impulse buys can quietly add $50-$100 each month to your grocery bill before you even realize it.

Checkout lanes? They're packed with snacks, magazines, and random little gadgets. Stores know you'll stand there, wallet in hand, and maybe grab something extra.

End-cap displays and those flashy promo aisles crank up the pressure with "limited time" offers. Shoppers often convince themselves they're saving money, but—let's be honest—they're usually spending more.

Strategic defenses against impulse buying:

- Make a detailed shopping list before you go

- Stick to your budget and chosen payment method

- Try not to shop when you're hungry or stressed

- Use self-checkout to dodge those last-minute temptations

Loyalty programs can nudge you into buying more, too. Points and member deals look like a win, but they often just bump up your total spend.

Expensive Unplanned Grocery Add-Ons

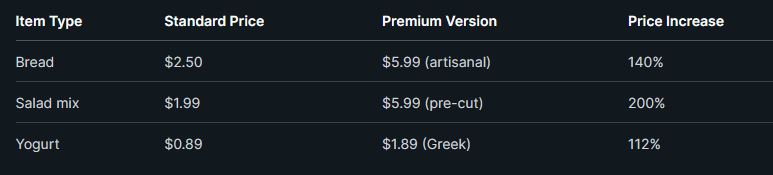

Premium versions of everyday basics sneakily inflate your bill. Fancy packaging, "organic" labels, and artisanal bread can cost two or three times as much as the regular stuff.

Brand names at eye level? That's no accident. Stores put pricier products where you'll spot them first, while the cheaper generics lurk on the bottom shelf.

Those pre-cut veggies, snack packs, and meal kits come with hefty markups. A bag of pre-washed lettuce can cost 300% more than just buying a head and chopping it yourself.

Cost comparison examples:

Seasonal or holiday packaging? It's often the same product, just with a higher price tag for the occasion.

Convenience and Delivery Service Charges

Grocery delivery services sneak in all sorts of fees. Delivery, service charges, tips, and price markups can really add up for frequent users.

Most platforms tack on delivery fees between $2.99 and $7.99 per order, then hit you with another 10-15% service fee. Even big orders aren't immune.

Hidden delivery cost breakdown:

- Base delivery fee: $3.99-$6.99

- Service fee: 10-15% of your order

- Driver tip: 15-20% expected

- Item markup: 10-20% over in-store prices

- Small order fees: $2.00-$3.00 extra

Subscription services sound like a deal with "free" delivery, but you have to commit for a year and hit minimum order amounts. A lot of folks pay for these but barely use them enough to make it worthwhile.

Convenience charges pile up fast if you use delivery regularly—sometimes $200-$400 a month more than just shopping yourself.

Lifestyle Spending and Discretionary Costs

Your daily habits usually hide the sneakiest money leaks in personal budgets. Marketing and the lure of convenience push us into routines where small spends quietly snowball over time.

Unnoticed Dining and Takeout Costs

Ordering out or dining in brings more hidden costs than you might think. Food delivery and restaurant bills are loaded with fees, tips, and markups that can double your actual meal cost.

That $12 lunch? It can hit $18 after taxes, tips, and delivery. Grab a $5 coffee every workday and you're looking at $1,300 a year—kind of wild.

Hidden dining costs include:

- Delivery fees ($2-5 per order)

- Service charges (15-20%)

- Convenience store markups (30-50%)

- Wasted leftovers from huge restaurant portions

Most of us don't realize how much these little charges add up until we check our credit card statements and see the real damage.

Meal delivery apps often bump up menu prices compared to what you'd pay in person. That convenience can quietly tack on $200-400 a month to your food budget if you're not careful.

Small Daily Habits That Add Up

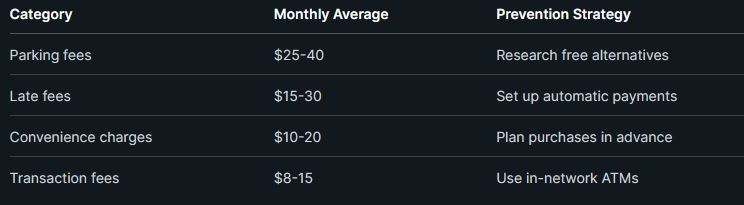

Those tiny, daily spends—coffee, snacks, parking—seem harmless, but they drain your budget over the year. Each one feels like no big deal, but together? Ouch.

Common daily spending patterns:

- Fancy coffee: $5 × 250 days = $1,250

- Vending snacks: $2 × 200 days = $400

- Parking: $3 × 100 days = $300

- Quick convenience store runs: $8 × 50 days = $400

Gas stations usually charge 20-40% more than grocery stores for snacks and drinks. Even workplace cafeterias can gouge you for basics you could bring from home.

Subscription boxes for coffee, snacks, or meal kits just keep the charges coming. It's easy to forget about them until you check your bank account and wonder where your money went.

People tend to sweat over big purchases and ignore the $3-$10 spends. But those little ones add up way faster than you'd expect.

Impulse Buying Triggered by Marketing Tactics

Modern marketing plays on your instincts, making impulse spending way too easy. Impulse buys and retail subscriptions use targeted ads and frictionless checkout to bypass your better judgment.

Primary marketing triggers:

- Limited-time deals that make you panic-buy

- Email promos with "special" discounts

- One-click shopping that cuts down your thinking time

- Social media ads tailored to your browsing

Stores put those impulse items right where you'll see them at checkout. Online, algorithms push "you might also like" suggestions while you're already shopping.

Subscriptions turn impulse buying into a habit. Free trials flip into paid memberships, and upgrade nudges push you into pricier plans without much thought.

Retail psychology tactics:

- Anchoring: Showing a fake high price first

- Scarcity: "Only 2 left!" warnings

- Social proof: Loads of glowing reviews

- Bundling: Package deals that tempt you to spend more

Promotional emails actually make people spend 15-25% more compared to folks who don't get them. If you unsubscribe from marketing blasts, you could cut your monthly extra spending by 10-15%—and probably not even miss the stuff.

Home, Utilities, and Energy Charges You May Miss

Home energy bills are full of sneaky costs that build up from inefficient habits and old appliances. Energy expenses often hide in plain sight, showing up as mystery charges on your utility statement.

Energy Consumption and Efficiency Pitfalls

Electronics and appliances keep sipping power even when they're "off". TVs, monitors, gaming consoles, and anything with a digital display quietly add to your bill.

Standby power can eat up 5-10% of your home's electricity. Just leaving a cable box plugged in all year can cost you $17 and you might not even notice.

Common Energy Vampires:

- Coffee makers with clocks

- Printers and scanners

- Chargers left plugged in

- Entertainment centers with remotes

- Microwaves with LED displays

Smart power strips help by cutting power when devices aren't in use. Unplugging stuff you don't need? That works, too.

Old appliances are energy hogs. If your fridge is from before 2001, it probably uses 40% more electricity than a newer Energy Star model.

Programmable Thermostats and Appliance Choices

Manually changing your thermostat can lead to big swings in heating or cooling bills. Programmable thermostats take the guesswork out and adjust temps based on your schedule.

Using one can save you 10-23% on heating and cooling each year. Just setting it 7-10 degrees lower while you sleep can shave 10% off your heating costs.

Optimal Temperature Settings:

- Winter: 68°F when home, 60-65°F when away

- Summer: 78°F when home, 85°F when away

- Sleep: 65°F in winter, 75°F in summer

Where you put your appliances matters, too. A fridge next to the oven works harder, and a dryer in a cold basement burns more energy.

Setting your water heater above 120°F wastes energy. Dropping it by 10 degrees saves you 3-5% on water heating costs.

How to Spot and Eliminate Hidden Costs

If you want to find where your money's really going, look over your statements and keep tabs on those recurring charges. Tracking subscriptions and reviewing spending can stop those small leaks before they turn into budget busters.

Reviewing Credit Card and Bank Statements

When you review monthly statements, you start to notice patterns that automated spending hides. Most folks just glance at the totals and skip the details, letting recurring charges sneak by and pile up over time.

Credit card statements really lay bare the sneaky subscription creep and those hidden fees. Watch for charges under $20 that show up every month—these usually point to forgotten services or trial periods that quietly switched to paid plans.

Banks split transactions into categories, which helps you spot anything weird. Focus on these areas:

- Monthly recurring charges between $5-50

- Foreign transaction fees on domestic purchases

- ATM fees from out-of-network withdrawals

- Overdraft charges that indicate timing issues

Pick a day each month to do this review. Honestly, Wednesday mornings seem to work because there are usually fewer distractions.

It helps to make a simple spreadsheet that lists every recurring charge, its amount, and when it renews. Seeing it all in one place makes it easier to figure out what's actually worth keeping.

Using Tools to Track and Cancel Subscriptions

Subscription management tools take over the tedious parts that manual reviews miss. These apps connect to your bank accounts and spot recurring payments across all your cards.

Rocket Money stands out because it lets you cancel subscriptions right from the app. No need to mess with confusing websites or endless customer service calls.

The app sorts your subscriptions by cost and frequency, so you can see which ones are draining your wallet the fastest. It also flags price hikes that companies tend to sneak in without saying much.

Other options worth a look:

- Mint for basic subscription spotting

- Truebill for easy cancellations

- Honey for mixing in coupons with subscription management

Most of these tools have free versions that just identify subscriptions. If you want help canceling or need spending alerts, you'll probably need to pay for premium features.

The biggest perk of automated tracking? You catch subscriptions scattered across different cards. A lot of people use multiple payment methods, so doing this by hand never catches everything.

Budgeting for Unexpected Charges

Unexpected charges feel less overwhelming when you build them into your budget. Most budgets flop because they only cover fixed costs and ignore the stuff that pops up randomly.

Add a "miscellaneous charges" category—make it about 3-5% of your monthly income. This covers parking, late fees, and those little costs that don't fit anywhere else.

Track daily spending for a month and see what surprises come up. Usually, people find they spend $50-100 on so-called "random" charges, but there's a pattern if you look closely.

Here are some common unexpected charges to watch for:

Keep your emergency fund separate from the miscellaneous budget. The miscellaneous bucket is for stuff you can kind of predict, while emergencies are for real surprises.

Give this category a review every few months and tweak the amount if your spending changes. Most people can save money after they figure out and cut those "unexpected" charges that keep coming back.

Building Financial Security Through Mindful Spending

When you stick to consistent spending habits and start thinking ahead with your financial strategies, it really changes your whole approach to money management. Financial mindfulness helps you connect with your own money—and honestly, it can lower stress and cut down on buyer's remorse.

Adopting Consistent Spending Habits

Sticking to consistent spending habits builds the foundation for long-term financial security. People who track expenses daily start to notice where their money actually goes—and where it just disappears.

Daily expense tracking means jotting down every purchase, even the small stuff like coffee or parking. This habit reveals what triggers your spending and those emotional buys that add up quietly.

Mindful spending gives you more control by making you pause and think before you buy. The 24-hour rule helps—just wait a day before buying anything that isn't essential, and see if you still want it.

Automated systems can help you keep up. Set up auto-transfers to savings or schedule bill payments so you don't get hit with late fees.

Some habit tweaks worth trying:

- Review your bank statements every week

- Use cash for things like coffee or eating out

- Unsubscribe from promo emails (they're just temptation)

- Check your balance before you buy something

Creating a Proactive Financial Plan

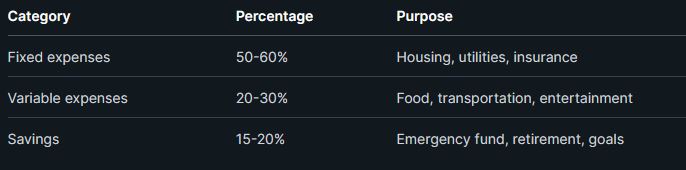

When you plan your finances proactively, you try to spot expenses before they turn into emergencies. I find that reviewing your budget every month helps you catch trends and tweak spending categories based on what you're actually doing.

Emergency funds act as your safety net when life throws a curveball. Stashing away three to six months' worth of expenses isn't always easy, but it gives you a real sense of security when hidden costs pop up out of nowhere.

Budget allocation strategy:

When I do a financial audit, I usually spot subscriptions or recurring charges that just aren't worth it anymore. Canceling these unused services can easily free up $100 or more every month—who doesn't want that?

Budgeting apps make tracking your money a lot less painful. They'll sort your expenses automatically and send you a heads-up if you're about to blow past your limits in any category.

It's smart to set aside time each year to look over your insurance, investments, and debt payoff plans. That way, you can make sure everything still lines up with what you want out of your money now—not what you wanted last year.

Thrift stores give you the chance to score unique stuff without breaking the bank or adding to landfill waste. Still, walking into a second-hand shop for the first time can feel like information overload—aisles packed, shelves overflowing, and you're not sure where to even start.

Home bartending has changed a lot lately. What used to be a casual hobby now brings cocktail culture right into the living room.

4 European Destinations for a Cheap Winter Holiday: Budget-Friendly Escapes for Cold Weather Travel

Winter travel in Europe doesn't have to drain your bank account. Plenty of destinations let you soak up culture, history, and all the cozy cold-weather vibes—without those sky-high summer prices.

People often think minimalism means shelling out for fancy organizers or trendy storage bins. That belief keeps a lot of folks from even trying to simplify—and honestly, it's just not true.

Most of us pay attention to our big-ticket expenses, but those sneaky, recurring charges? They slip by almost unnoticed every month. Hidden costs can quietly drain hundreds or even thousands of dollars a year from your budget—70% of consumers underestimate their monthly recurring charges.