Growing fresh herbs, veggies, and flowers in your apartment? Totally doable, even if you're short on space. Starting a mini apartment garden might actually save you some cash on groceries—especially with herbs and salad greens—but your setup costs and plant choices will shape how much you save.

What Is the Frugal Mindset? Essential Guide to Sustainable Wealth

Most of us wrestle with our finances, trying to find that sweet

spot between spending and saving. In a world obsessed with buying,

upgrading, and keeping up with the Joneses, it's easy to feel lost or

even a bit anxious about where your money's going.

A frugal mindset is a deliberate approach to money management that prioritizes mindful spending, distinguishes between needs and wants, and focuses on maximizing value rather than minimizing cost. Instead of falling for impulse buys or outside pressure, this way of thinking lets you make choices that actually match your goals and what matters to you.

Learning how to nurture this mindset can totally change how you relate to money. It's not just about clipping coupons or pinching pennies—it's a bigger philosophy about how we use resources and live more sustainably, both for ourselves and the folks around us.

Defining the Frugal Mindset

A frugal mindset is about being conscious with your resources—choosing value and intention over mindless spending. It's not about deprivation; it's about making choices that fit your bigger financial picture and, honestly, your quality of life.

Core Principles of Frugality

Frugality isn't just a buzzword. There are three main ideas that keep it grounded.

Value maximization comes first. People who think frugally weigh every purchase for what it gives them per dollar—durability, function, and whether it'll last matter more than just the sticker price.

Mindful consumption is next. This means pausing to ask if you really need something or just want it. That little pause can be surprisingly revealing.

Resource optimization rounds things out. This is about using what you have, repurposing, and finding ways to get more life out of your stuff. Maybe you fix things instead of tossing them, or you find cheaper ways to get the same result.

There's also the idea of delayed gratification. Waiting before you buy something non-essential helps you separate out the "I want it now" from the "do I really need it?"—and sometimes, you realize you don't.

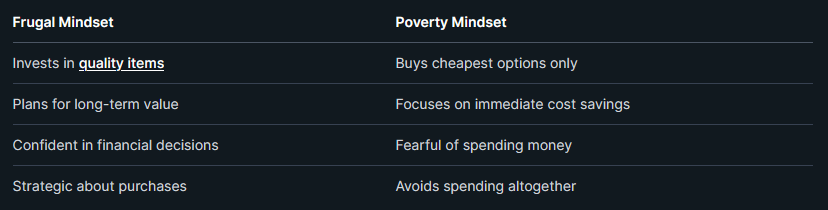

Frugal Mindset vs. Poverty Mindset

It's easy to mix these up, but they're not the same. The difference really matters if you're trying to build better habits with money.

Frugality is about choice and abundance thinking. You spend carefully because you value your money and want to use it well. It's empowering, not restrictive.

The poverty mindset, though, comes from scarcity and fear. It's about hoarding, feeling anxious about every dollar, and sometimes making choices that backfire in the long run.

Someone with a frugal mindset might drop extra cash on a solid pair of shoes because they'll last years. With a poverty mindset, you might keep buying the cheapest shoes over and over, even if they fall apart quickly.

Quality Over Quantity in Decision-Making

Frugal folks aren't out there hoarding stuff. They want fewer, better things, not piles of junk that'll break in a month.

Research and evaluation matter a lot. Reading reviews, comparing specs, doing the math on cost-per-use—they do their homework before buying.

They care about durability. If something lasts five times as long, paying a bit more upfront just makes sense.

And then there's multi-functionality. A jacket that works for rain, snow, and wind? Way better than three different coats cluttering up the closet.

This isn't just about stuff, either. People with a frugal mindset look for quality in services too—healthcare, education, even who cuts their hair. Cutting corners here can get expensive fast.

When they buy something big, they see it as an investment. If the long-term payoff is there, they're okay with the initial cost.

Key Benefits of a Frugal Mindset

Thinking frugally can seriously boost your financial stability, lower your stress, and—maybe surprisingly—help the environment. It's not just about the money, honestly.

Achieving Financial Freedom and Stability

Frugality helps you build financial freedom by widening the gap between what you earn and what you spend. People who live this way often save way more—sometimes 20-30% more—than average.

It also means you're not putting all your eggs in one basket. Many frugal people invest in different things—stocks, real estate, side hustles. They're not stuck if one thing goes wrong.

Some financial wins:

- Emergency funds that could cover you for 6-12 months

- The chance to retire earlier, if that's your thing

- Less debt and fewer interest payments hanging over your head

- More breathing room when the economy gets weird

Even saving an extra $500 a month adds up. Over 20 years, with average returns, that's over $200,000—not too shabby.

Reduced Financial Stress

Let's be real: money stress is brutal. But frugal habits can help a lot. People with emergency savings are way less stressed—some studies say 40% less—than folks living paycheck to paycheck.

When you shift from always wanting more to just wanting security, your anxiety drops. You worry less about surprise bills or layoffs.

How stress goes down:

- Budgets and predictable expenses

- Backup plans for when life throws a curveball

- No pressure to keep up with expensive trends

- More confidence in your financial choices

Plenty of people say they sleep better and fight less about money with their partners after getting frugal. It's not a cure-all, but it sure helps.

Positive Environmental Impact

Frugal living isn't just good for your wallet—it's a win for the planet, too. The average frugal household produces 30-40% less waste than the typical consumer. That's a lot less trash.

Buying things that last, fixing instead of tossing, and picking quality over quantity all mean less manufacturing and less landfill junk.

Eco-friendly perks:

- Lower carbon footprint from buying less

- Way less packaging waste piling up

- Longer product life thanks to repairs

- Supporting local and sustainable businesses

It's not just talk. Lots of frugal folks walk, bike, or use public transit instead of driving everywhere. Some grow their own veggies, preserve food, or shop secondhand. It's all part of the mindset.

Building and Sustaining Frugal Habits

Building real, lasting frugal habits doesn't happen overnight. It takes some practice—mainly with intentional spending, daily routines, and always learning more about money.

Mindful Spending and Intentional Financial Decisions

Mindful spending is the backbone of frugal living. Before buying, you have to check in: does this fit my values and goals, or am I just buying out of habit?

The 24-hour rule is a lifesaver. Wait a day before buying non-essentials, and you'll be surprised how often you just don't want it anymore.

Questions to ask yourself:

- Does this fit my long-term goals?

- Could I solve the same problem another way?

- Is this going to last or just end up in a drawer?

Big decisions need even more thought. Research investments, weigh the risks, and don't just jump in because someone else said so.

Emergency funds come first. Most experts say save up three to six months of living expenses before you start getting fancy with investments.

When it comes to debt, hit the high-interest stuff first. The avalanche method works: pay off the most expensive debt while keeping up with the rest.

Frugal Habits and Daily Practices

Small, steady habits add up. You don't need a dramatic life overhaul—just a few tweaks can make a big difference over time.

Everyday frugal moves:

- Cook at home instead of always eating out

- Walk or take the bus when you can

- Buy generic brands for basics

- Price check before you buy anything big

- Take care of your stuff so it lasts

Setting up automatic transfers to savings or using budgeting apps makes things easier. Out of sight, out of mind, but in a good way.

Try to use things up before replacing them. Fix clothes, reuse containers, borrow tools from neighbors—little things, but they add up.

And don't forget about energy bills. Turning down the thermostat, unplugging gadgets, and switching to LED bulbs can knock down your monthly costs.

Investing in Financial Education

Knowing the basics of money is crucial. People who understand investing and finance usually come out ahead in the long run.

There's a ton of free info out there—library books, online courses, podcasts. Some community colleges even have affordable classes if you want something more structured.

Understanding stuff like compound interest or diversification helps you grow your money smarter, not just harder.

Must-know concepts:

- Emergency funds for life's surprises

- Index funds to keep things simple and steady

- Tax-advantaged accounts like 401(k)s and IRAs

- Dollar-cost averaging so you don't try to time the market

If things get complicated, don't be afraid to ask for help. Fee-only advisors give advice without trying to sell you something.

Keep learning, because the world of money changes fast. Reading up on trends and new tools keeps your strategy fresh—and maybe even a little exciting.

Overcoming Challenges in Adopting Frugality

Lots of folks hit resistance when they try to live more frugally. Social expectations and the idea that frugality is all sacrifice can really get in the way.

Honestly, dealing with peer pressure while still having a good time takes some creativity. It's not always easy to come up with practical strategies that feel natural.

Navigating Social Pressures and Misconceptions

Social circles sometimes push people to spend on things that don't fit with a frugal lifestyle. Friends might want you to join them for pricey dinners or shopping sprees, and it can get awkward fast.

Common misconceptions about frugal people include:

- They're cheap or stingy with others

- They never enjoy life or have fun

- They deprive themselves of all pleasures

- They're obsessed with money

It helps when frugal types just explain where they're coming from. Letting people know it's about intentional spending—not being broke—tends to clear the air a bit.

Effective strategies include:

- Suggesting alternative low-cost activities like hiking or home gatherings

- Practicing confident responses to spending pressure

- Finding friends who support their frugal lifestyle choices

- Setting boundaries around financial discussions

It's tough, but staying focused on your own goals usually matters more than keeping up appearances. People tend to respect honesty, especially if you're not judging how they spend their own money.

Balancing Frugality With Enjoyment

Living frugally doesn't mean you never have fun. The trick is building in enjoyment so you don't feel deprived and end up ditching your budget altogether.

Smart budgeting means actually setting aside money for things you enjoy. If you've planned for treats, you don't have to feel guilty when you indulge a little.

Practical approaches include:

- Creating a monthly "fun fund" for discretionary spending

- Choosing experiences over material possessions

- Finding free or low-cost entertainment options

- Celebrating financial milestones with modest rewards

Sometimes, the simple stuff—like a movie night at home—ends up being more memorable than the expensive outings. It's funny how that works out.

It's less about how much you spend and more about being intentional with it. That's what helps avoid regret and keeps the fun in frugality, at least in my experience.

Leveraging DIY Projects and Thrifty Solutions

DIY projects can save a surprising amount of money. Plus, there's something oddly satisfying about fixing or creating things with your own hands.

They're not just about pinching pennies—they're also a chance to pick up new skills and maybe even have a little fun along the way.

High-impact DIY areas include:

- Basic home repairs and maintenance

- Cooking meals instead of dining out

- Creating gifts and decorations

- Growing vegetables and herbs

- Simple car maintenance tasks

Honestly, starting small is key. Tackle a simple project or two, and your confidence will grow for bigger stuff.

There's no shortage of free guidance out there. YouTube is packed with tutorials, and the local library? Still a goldmine for DIY books.

But thrifty living isn't just about gluing things together or sewing up holes. It's also about being clever with everyday spending.

Think: comparing prices, hunting for coupons, or timing your buys to hit the best sales.

Money-saving approaches:

- Shopping secondhand stores first

- Repairing items before replacing them

- Borrowing tools for occasional projects

- Trading services with neighbors

- Batch cooking to reduce food costs

Personally, I've found that these habits don't just pad your wallet—they make life a bit more interesting. There's a certain pride in making or fixing something yourself, and it's nice not to default to buying every time.

Thrift stores give you the chance to score unique stuff without breaking the bank or adding to landfill waste. Still, walking into a second-hand shop for the first time can feel like information overload—aisles packed, shelves overflowing, and you're not sure where to even start.

Home bartending has changed a lot lately. What used to be a casual hobby now brings cocktail culture right into the living room.